Page 55 - Investing in the Praetura Group

P. 55

55

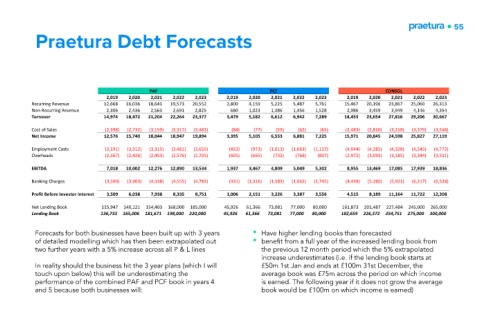

Praetura Debt Forecasts

PAF PCF CONSOL

2,019 2,020 2,021 2,022 2,023 2,019 2,020 2,021 2,022 2,023 2,019 2,020 2,021 2,022 2,023

Recurring Revenue 12,668 16,036 18,641 19,573 20,552 2,800 4,159 5,225 5,487 5,761 15,467 20,196 23,867 25,060 26,313

Non-Recurring Revenue 2,306 2,436 2,563 2,691 2,825 680 1,023 1,386 1,456 1,528 2,986 3,459 3,949 4,146 4,354

Turnover 14,974 18,472 21,204 22,264 23,377 3,479 5,182 6,612 6,942 7,289 18,453 23,654 27,816 29,206 30,667

Cost of Sales (2,398) (2,732) (3,159) (3,317) (3,483) (84) (77) (59) (62) (65) (2,483) (2,810) (3,218) (3,379) (3,548)

Net Income 12,576 15,740 18,044 18,947 19,894 3,395 5,105 6,553 6,881 7,225 15,971 20,845 24,598 25,827 27,119

Employment Costs (3,191) (3,312) (3,315) (3,481) (3,655) (853) (973) (1,013) (1,063) (1,117) (4,044) (4,285) (4,328) (4,545) (4,772)

Overheads (2,367) (2,426) (2,453) (2,576) (2,705) (605) (665) (732) (768) (807) (2,972) (3,091) (3,185) (3,344) (3,511)

EBITDA 7,018 10,002 12,276 12,890 13,534 1,937 3,467 4,809 5,049 5,302 8,955 13,469 17,085 17,939 18,836

Banking Charges (3,509) (3,963) (4,338) (4,555) (4,783) (931) (1,316) (1,583) (1,662) (1,745) (4,439) (5,280) (5,921) (6,217) (6,528)

Profit Before Investor Interest 3,509 6,038 7,938 8,335 8,751 1,006 2,151 3,226 3,387 3,556 4,515 8,189 11,164 11,722 12,308

Net Lending Book 115,947 140,121 154,403 168,000 185,000 45,926 61,366 73,081 77,000 80,000 161,873 201,487 227,484 245,000 265,000

Lending Book 136,733 165,006 181,671 198,000 220,000 45,926 61,366 73,081 77,000 80,000 182,659 226,372 254,751 275,000 300,000

Forecasts for both businesses have been built up with 3 years • Have higher lending books than forecasted

of detailed modelling which has then been extrapolated out • benefit from a full year of the increased lending book from

two further years with a 5% increase across all P & L lines the previous 12 month period which the 5% extrapolated

increase underestimates (i.e. if the lending book starts at

In reality should the business hit the 3 year plans (which I will £50m 1st Jan and ends at £100m 31st December, the

touch upon below) this will be underestimating the average book was £75m across the period on which income

performance of the combined PAF and PCF book in years 4 is earned. The following year if it does not grow the average

and 5 because both businesses will: book would be £100m on which income is earned)