Page 63 - Investing in the Praetura Group

P. 63

63

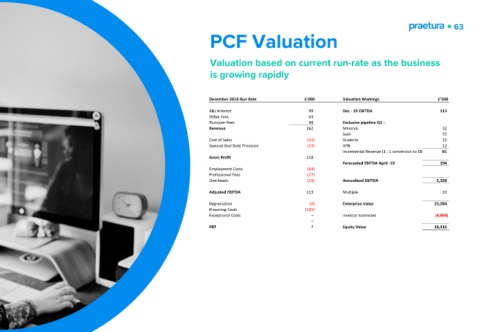

PCF Valuation

Valuation based on current run-rate as the business

is growing rapidly

December 2018 Run Rate £'000 Valuation Workings £'000

ABL Interest 99 Dec - 19 EBITDA 113

Other Fees 63

Turnover Fees 99 Exclusive pipeline Q1 :

Revenue 262 Minerva 32

Sash 22

Cost of Sales (24) Scuderia 15

General Bad Debt Provision (19) APB 12

Incremental Revenue (1 : 1 conversion to EB 81

Gross Profit 218

Forecasted EBITDA April -19 194

Employment Costs (64)

Professional Fees (27)

Overheads (15) Annualised EBITDA 2,328

Adjusted EBITDA 113 Multiple 10

Depreciation (0) Enterprise Value 23,284

Financing Costs (105)

Exceptional Costs – investor loannotes (6,868)

–

PBT 7 Equity Value 16,416