Page 173 - Capricorn IAR 2020

P. 173

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

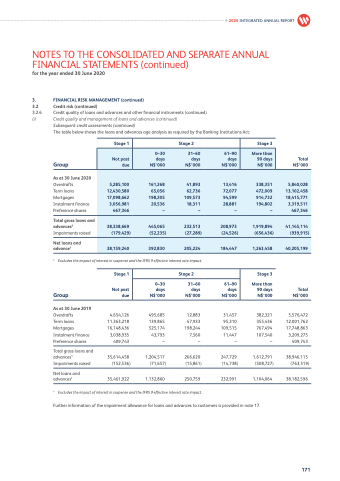

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.6 Credit quality of loans and advances and other financial instruments (continued)

(i) Credit quality and management of loans and advances (continued)

Subsequent credit assessments (continued)

The table below shows the loans and advances age analysis as required by the Banking Institutions Act:

Stage 1

Stage 3

2020 INTEGRATED ANNUAL REPORT

467,346

(179,429)

38,159,240

–

Stage 2

Not past due

0–30 days N$’000

31–60 days N$’000

18,311

(27,289)

205,224

61–90 days N$’000

(24,526)

184,447

–

More than 90 days N$’000

5,285,100

12,430,580

17,098,662

3,056,981

161,268

65,056

198,205

20,536

41,893

62,736

109,573

13,416

72,077

94,599

28,881

338,351

472,009

914,732

194,802

(656,436)

1,263,458

–

5,840,028

13,102,458

18,415,771

3,319,511

467,346

38,338,669

(52,235)

232,513

–

445,065

208,973

1,919,894

41,145,114

(939,915)

392,830

40,205,199

Group

As at 30 June 2020

Overdrafts

Term loans Mortgages Instalment finance Preference shares

Total gross loans and advances1 Impairments raised

Net loans and advance1

Total N$’000

1 Excludes the impact of interest in suspense and the IFRS 9 effective interest rate impact.

Stage 2

0–30 days N$’000

31–60 days N$’000

61–90 days N$’000

Stage 1

Not past Group due

As at 30 June 2019

Overdrafts 4,654,126 Term loans 11,363,218 Mortgages 16,148,436 Instalment finance 3,038,935 Preference shares 409,743

Total gross loans and

advances1 35,614,458 Impairments raised (152,536)

Net loans and

advances1 35,461,922

495,685 139,865 525,174

43,793 –

1,204,517 (71,657)

1,132,860

12,883

47,933 198,244 7,560 –

266,620 (15,861)

250,759

31,457

95,310 109,515 11,447 –

247,729 (14,738)

232,991

Stage 3

More than 90 days N$’000

382,321 355,436 767,494 107,540

–

1,612,791 (508,727)

1,104,064

Total N$’000

5,576,472 12,001,762 17,748,863

3,209,275 409,743

38,946,115 (763,519)

38,182,596

1 Excludes the impact of interest in suspense and the IFRS 9 effective interest rate impact.

Further information of the impairment allowance for loans and advances to customers is provided in note 17.

171