Page 174 - Capricorn IAR 2020

P. 174

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.6 Credit quality of loans and advances and other financial instruments (continued)

(ii) Non-performing loans and advances

Loans and advances are managed with reference to the days in arrears. Days in arrears are calculated based on the amount past due relative to the instalment amount. Loans and advances outstanding for longer than 90 days are considered non-performing and are included in stage 3 for the loss allowance calculation. As determined by the regulatory requirements, any asset which is overdue 30 days or more but less than 90 days shall be classified as special mention, at a minimum and is subject to impairment in accordance with the stage 2 calculations. The Group follows a more conservative approach than the regulators and already classifies loans in 0–30 days on a watchlist, where, on a case-by-case basis, indicators of a possible future loss event exist. Additionally, loans that are made to a specific industry or individuals that are not past due, but we deem to be risky are assessed and in certain instances subject to impairment in accordance with the stage 2 calculations. Loans categorised on the watchlist are performing but subject to the impairment in accordance to the IFRS 9 calculations.

Non-performing loans and advances to customers before taking into consideration the cash flows from collateral held is N$1.9 billion (2019: N$1.6 billion). The increase in non-performing loans and advances is mainly due to the deterioration of the macroeconomic environment.

Refer to note 3.2.3 a) for the range of collateral policies and practices in place.

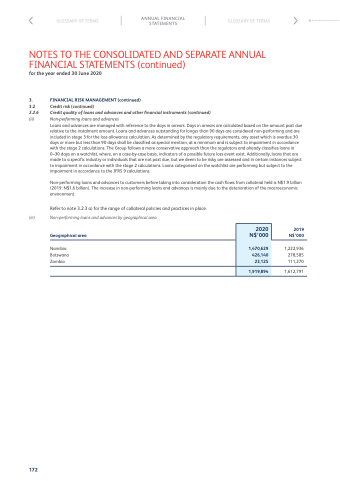

(iii) Non-performing loans and advances by geographical area

Geographical area

Namibia Botswana Zambia

2019 N$’000

1,222,936 278,585 111,270

1,612,791

2020 N$’000

1,470,629

426,140

23,125

1,919,894

172