Page 175 - Capricorn IAR 2020

P. 175

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.6 Credit quality of loans and advances and other financial instruments (continued)

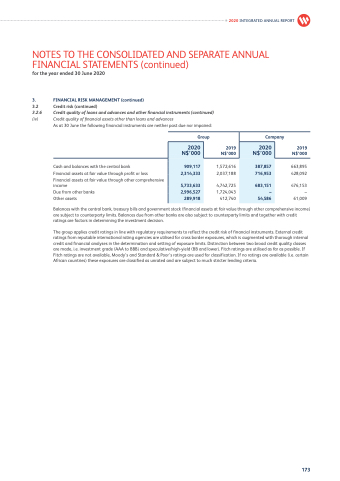

(iv) Credit quality of financial assets other than loans and advances

As at 30 June the following financial instruments are neither past due nor impaired:

Group

Cash and balances with the central bank Financial assets at fair value through profit or loss

Financial assets at fair value through other comprehensive

income 4,742,725 Due from other banks 1,724,043 Other assets 412,740

Balances with the central bank, treasury bills and government stock (financial assets at fair value

are subject to counterparty limits. Balances due from other banks are also subject to counterparty limits and together with credit ratings are factors in determining the investment decision.

The group applies credit ratings in line with regulatory requirements to reflect the credit risk of financial instruments. External credit ratings from reputable international rating agencies are utilised for cross border exposures, which is augmented with thorough internal credit and financial analyses in the determination and setting of exposure limits. Distinction between two broad credit quality classes are made, i.e. investment grade (AAA to BBB) and speculative/high-yield (BB and lower). Fitch ratings are utilised as far as possible. If Fitch ratings are not available, Moody’s and Standard & Poor’s ratings are used for classification. If no ratings are available (i.e. certain African countries) these exposures are classified as unrated and are subject to much stricter lending criteria.

2020 INTEGRATED ANNUAL REPORT

Company

2020 N$’000

2019 N$’000

1,572,616 2,037,188

2019 N$’000

663,895 428,092

476,153 – 61,009

2020 N$’000

909,117

387,857

2,314,333

716,953

5,733,633

683,151

2,996,527

289,918

54,586

–

through other comprehensive income)

173