Page 177 - Capricorn IAR 2020

P. 177

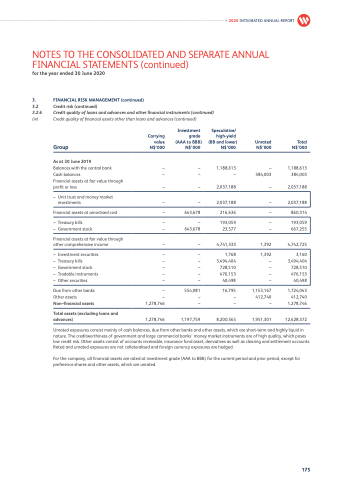

(iv) Credit quality of financial assets other than loans and advances (continued)

Carrying value Group N$’000

As at 30 June 2019

Balances with the central bank Cash balances

Financial assets at fair value through profit or loss

– Unit trust and money market investments

Financial assets at amortised cost

– Treasury bills

– Government stock

Financial assets at fair value through other comprehensive income

– Investment securities – Treasury bills

– Government stock

– Tradable instruments – Other securities

Due from other banks Other assets Non–financial assets

Speculative/ high-yield

Total N$’000

1,188,613 384,003

2,037,188 2,037,188

860,314

193,059 667,255

4,742,725

3,160 3,494,404 728,510 476,153 40,498

1,724,043 412,740 1,278,746

12,628,372

Investment grade

(AAA to BBB)

N$’000 N$’000 N$’000

(BB and lower)

Unrated

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.6 Credit quality of loans and advances and other financial instruments (continued)

– – – –

– – – –

– 643,678

– – – 643,678

– –

– – – – – – – – – –

– 554,081

– – 1,278,746 –

1,188,613 – – 384,003

2,037,188 – 2,037,188 –

216,636 –

193,059 – 23,577 –

4,741,333 1,392

1,768 1,392 3,494,404 – 728,510 – 476,153 – 40,498 –

16,795 1,153,167 – 412,740 – –

8,200,565 1,951,301

Total assets (excluding loans and

advances) 1,278,746

1,197,759

Unrated exposures consist mainly of cash balances, due from other banks and

nature. The creditworthiness of government and large commercial banks’ money market instruments are of high quality, which poses low credit risk. Other assets consist of accounts receivable, insurance fund asset, derivatives as well as clearing and settlement accounts. Rated and unrated exposures are not collateralised and foreign currency exposures are hedged.

For the company, all financial assets are rated at investment grade (AAA to BBB) for the current period and prior period, except for preference shares and other assets, which are unrated.

other assets, which are short-term and highly liquid in

175