Page 178 - Capricorn IAR 2020

P. 178

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.6 Credit quality of loans and advances and other financial instruments (continued)

(iv) Credit quality of financial assets other than loans and advances (continued)

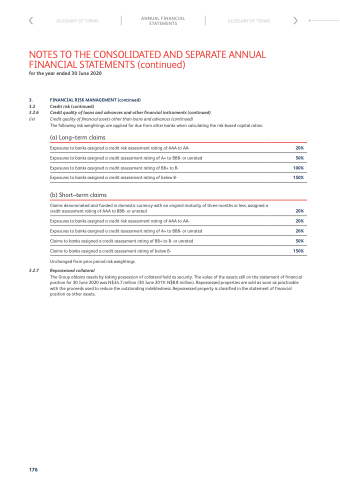

The following risk weightings are applied for due from other banks when calculating the risk-based capital ratios:

(a) Long–term claims

Exposures to banks assigned a credit risk assessment rating of AAA to AA- 20% Exposures to banks assigned a credit assessment rating of A+ to BBB- or unrated 50% Exposures to banks assigned a credit assessment rating of BB+ to B- 100% Exposures to banks assigned a credit assessment rating of below B- 150%

(b) Short–term claims

Claims denominated and funded in domestic currency with an original maturity of three months or less, assigned a

credit assessment rating of AAA to BBB- or unrated 20% Exposures to banks assigned a credit risk assessment rating of AAA to AA- 20% Exposures to banks assigned a credit assessment rating of A+ to BBB- or unrated 20% Claims to banks assigned a credit assessment rating of BB+ to B- or unrated 50% Claims to banks assigned a credit assessment rating of below B- 150% Unchanged from prior period risk weightings.

3.2.7 Repossessed collateral

The Group obtains assets by taking possession of collateral held as security. The value of the assets still on the statement of financial position for 30 June 2020 was N$24.7 million (30 June 2019: N$8.8 million). Repossessed properties are sold as soon as practicable with the proceeds used to reduce the outstanding indebtedness. Repossessed property is classified in the statement of financial position as other assets.

176