Page 179 - Capricorn IAR 2020

P. 179

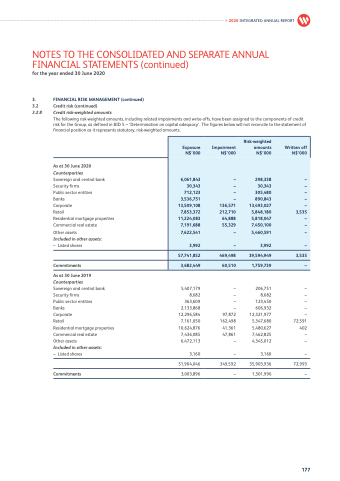

risk for the Group, as defined in BID 5 – ‘Determination on capital adequacy’. financial position as it represents statutory, risk-weighted amounts.

As at 30 June 2020

Counterparties

Sovereign and central bank Security firms

Public sector entities

Banks

Corporate

Retail

Residential mortgage properties Commercial real estate

Other assets

Included in other assets:

– Listed shares

Commitments

As at 30 June 2019

Counterparties

Sovereign and central bank

Security firms

Public sector entities

Banks 2,133,868 Corporate 12,296,584 Retail 7,161,050

The figures below

will not reconcile to the statement of

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.8 Credit risk-weighted amounts

The following risk-weighted amounts, including related impairments and write-offs, have been assigned to the components of credit

Exposure N$’000

Impairment N$’000

Risk-weighted amounts N$’000

Written off N$’000

6,061,843

–

298,338

–

30,343

–

30,343

–

712,123

–

305,480

–

3,536,751

–

890,843

–

13,509,108

136,571

13,493,027

–

7,853,372

212,710

5,848,180

3,535

11,224,083

64,888

5,818,047

–

7,191,688

55,329

7,450,100

–

7,622,541

–

5,460,591

–

3,992

–

3,992

–

57,741,852

469,498

39,594,949

3,535

3,682,449

60,510

1,759,739

–

Residential mortgage properties Commercial real estate

Other assets

Included in other assets:

– Listed shares

10,624,876 7,436,085 6,472,113

3,160

51,904,046

5,407,179 8,682 363,609

– – – –

97,872 162,498 41,361 47,861 –

–

349,592

–

206,751 – 8,682 – 123,450 – 606,932 – 12,321,977 – 5,347,680 72,591 5,480,627 402 7,462,825 – 4,345,012 –

3,160 –

35,903,936 72,993

1,301,996 –

Commitments 3,003,896

177