Page 189 - Capricorn IAR 2020

P. 189

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.3 Market risk (continued)

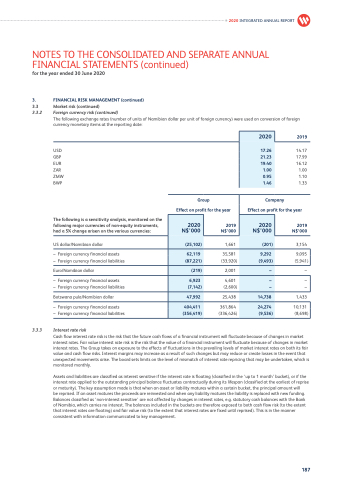

3.3.2 Foreign currency risk (continued)

The following exchange rates (number of units of Namibian dollar per unit of foreign currency) were used on conversion of foreign currency monetary items at the reporting date:

2020

17.26

21.23

19.40

1.00

0.95

1.46

USD GBP EUR ZAR ZMW BWP

The following is a sensitivity analysis, monitored on the following major currencies of non-equity instruments, had a 5% change arisen on the various currencies:

US dollar/Namibian dollar

– Foreign currency financial assets

– Foreign currency financial liabilities

Euro/Namibian dollar

– Foreign currency financial assets

– Foreign currency financial liabilities

Botswana pula/Namibian dollar

– Foreign currency financial assets

– Foreign currency financial liabilities

3.3.3 Interest rate risk

Group

Effect on profit for the year

2019 N$’000

2019

14.17 17.99 16.12

1.00 1.10 1.33

Company

Effect on profit for the year

2019 N$’000

3,154

–

1,433

2020 N$’000

(25,102)

1,661

2020 N$’000

(201)

62,119

35,581 (33,920)

9,292

9,095 (5,941)

(87,221)

(9,493)

(219)

2,001

–

6,923

(7,142)

47,992

4,601 (2,600)

361,864 (336,426)

14,738

–

–

– –

25,438

404,411

24,274

10,131 (8,698)

(356,419)

(9,536)

Cash flow interest rate risk is the risk that the future cash flows of a financial instrument will fluctuate because of changes in market interest rates. Fair value interest rate risk is the risk that the value of a financial instrument will fluctuate because of changes in market interest rates. The Group takes on exposure to the effects of fluctuations in the prevailing levels of market interest rates on both its fair value and cash flow risks. Interest margins may increase as a result of such changes but may reduce or create losses in the event that unexpected movements arise. The board sets limits on the level of mismatch of interest rate repricing that may be undertaken, which is monitored monthly.

Assets and liabilities are classified as interest sensitive if the interest rate is floating (classified in the ‘up to 1 month’ bucket), or if the interest rate applied to the outstanding principal balance fluctuates contractually during its lifespan (classified at the earliest of reprise or maturity). The key assumption made is that when an asset or liability matures within a certain bucket, the principal amount will

be reprised. If an asset matures the proceeds are reinvested and when any liability matures the liability is replaced with new funding. Balances classified as ‘non-interest sensitive’ are not affected by changes in interest rates, e.g. statutory cash balances with the Bank of Namibia, which carries no interest. The balances included in the buckets are therefore exposed to both cash flow risk (to the extent that interest rates are floating) and fair value risk (to the extent that interest rates are fixed until reprised). This is in the manner consistent with information communicated to key management.

187