Page 191 - Capricorn IAR 2020

P. 191

Group

Company

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.3 Market risk (continued)

3.3.3 Interest rate risk (continued)

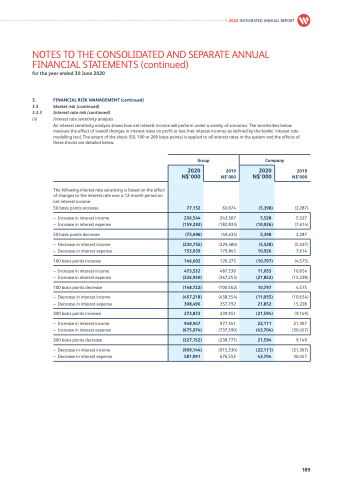

(ii) Interest rate sensitivity analysis

An interest sensitivity analysis shows how net interest income will perform under a variety of scenarios. The sensitivities below measure the effect of overall changes in interest rates on profit or loss (net interest income) as defined by the banks’ interest rate modelling tool. The extent of the shock (50, 100 or 200 basis points) is applied to all interest rates in the system and the effects of these shocks are detailed below.

2020 N$’000

2020 N$’000

77,152

60,674

(5,398)

236,544

243,507 (182,833)

5,528

(10,926)

5,327 (7,614)

(159,392)

(75,696)

(49,635)

(229,480) 179,845

5,398

(230,755)

(5,528)

(5,327) 7,614

155,059

10,926

146,602

120,275

(10,797)

473,532

487,530 (367,255)

11,055

10,654 (15,228)

(326,930)

(458,354) 357,792

(21,852)

(148,722)

(100,562)

10,797

(457,218)

(11,055)

(10,654) 15,228

308,496

21,852

273,872

239,951

(21,594)

948,947

977,341 (737,390)

22,111

(43,704)

21,307 (30,457)

(675,074)

(327,152)

(238,777)

581,991

(915,330) 676,553

21,594

(909,144)

(22,111)

(21,307) 30,457

43,704

2019 N$’000

2019 N$’000

(2,287)

2,287

(4,575)

4,575

(9,149)

9,149

The following interest rate sensitivity is based on the effect of changes to the interest rate over a 12-month period on net interest income:

50 basis points increase

– Increase in interest income – Increase in interest expense

50 basis points decrease

– Decrease in interest income – Decrease in interest expense

100 basis points increase

– Increase in interest income – Increase in interest expense

100 basis points decrease

– Decrease in interest income – Decrease in interest expense

200 basis points increase

– Increase in interest income – Increase in interest expense

200 basis points decrease

– Decrease in interest income – Decrease in interest expense

189