Page 190 - Capricorn IAR 2020

P. 190

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

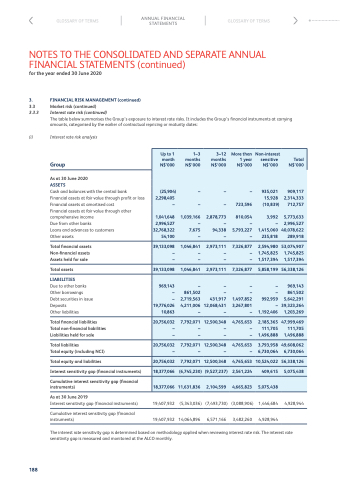

3. FINANCIAL RISK MANAGEMENT (continued)

3.3 Market risk (continued)

3.3.3 Interest rate risk (continued)

The table below summarises the Group’s exposure to interest rate risks. It includes the Group’s financial instruments at carrying amounts, categorised by the earlier of contractual repricing or maturity dates:

(i) Interest rate risk analysis

Group

As at 30 June 2020

ASSETS

Cash and balances with the central bank Financial assets at fair value through profit or loss Financial assets at amortised cost

Financial assets at fair value through other comprehensive income

Due from other banks

Loans and advances to customers

Other assets

Total financial assets Non-financial assets Assets held for sale

Total assets

LIABILITIES

Due to other banks Other borrowings Debt securities in issue Deposits

Other liabilities

Total financial liabilities Total non-financial liabilities Liabilities held for sale

Total liabilities

Total equity (including NCI)

Total equity and liabilities

Interest sensitivity gap (financial instruments)

Cumulative interest sensitivity gap (financial instruments)

As at 30 June 2019

Interest sensitivity gap (financial instruments)

Cumulative interest sensitivity gap (financial instruments)

Up to 1 1–3 month months N$’000 N$’000

3–12 months N$’000

–

–

2,878,773 – 94,338 –

2,973,111 – –

2,973,111

–

– 431,917 12,068,431 –

12,500,348 – –

12,500,348 –

12,500,348

More than 1 year N$’000

– 723,596

810,054 – 5,793,227 –

7,326,877 – –

7,326,877

–

– 1,497,852 3,267,801 –

4,765,653 – –

4,765,653 –

4,765,653

2,561,224

4,665,823

(3,088,906)

Non-interest sensitive N$’000

935,021

15,928 2,314,333

Total N$’000

(25,904) 2,298,405 –

1,041,648

2,996,527 32,768,322 54,100

39,133,098 – –

39,133,098

969,143 – – 19,776,026 10,863

20,756,032 – –

20,756,032 –

20,756,032

18,377,066

18,377,066

19,407,932

–

–

1,039,166 – 7,675 –

1,046,841 – –

1,046,841

– 861,502 2,719,563 4,211,006 –

7,792,071 – –

7,792,071 –

7,792,071

909,117

(6,745,230) (9,527,237)

11,631,836 2,104,599

(5,343,036) (7,493,730)

(10,839)

3,992 – 1,415,060 235,818

2,594,980 1,745,825 1,517,394

5,858,199

–

– 992,959 – 1,192,406

2,185,365 111,705 1,496,888

3,793,958 6,730,064

10,524,022

409,615

5,075,438

1,446,684

712,757

5,773,633

2,996,527 40,078,622 289,918

53,074,907 1,745,825 1,517,394

56,338,126

969,143

861,502 5,642,291 39,323,264 1,203,269

47,999,469 111,705 1,496,888

49,608,062 6,730,064

56,338,126

5,075,438

4,928,944

19,407,932 14,064,896 6,571,166 3,482,260 4,928,944

188

The interest rate sensitivity gap is determined based on methodology applied when reviewing interest rate risk. The interest rate sensitivity gap is measured and monitored at the ALCO monthly.