Page 207 - Capricorn IAR 2020

P. 207

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

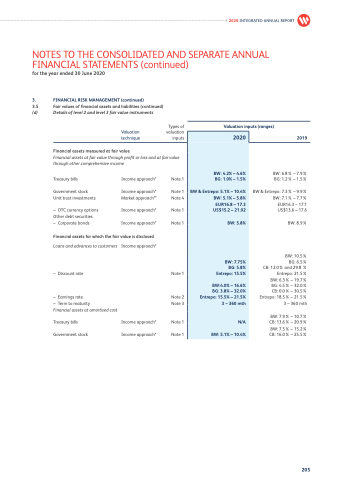

3. FINANCIAL RISK MANAGEMENT (continued)

3.5 Fair values of financial assets and liabilities (continued)

(d) Details of level 2 and level 3 fair value instruments

Valuation technique

Financial assets measured at fair value

Types of valuation inputs

Valuation inputs (ranges)

2020 INTEGRATED ANNUAL REPORT

2020

BW: 4.2% – 4.6% BG: 1.0% – 1.5%

BW & Entrepo: 5.1% – 10.4%

BW: 5.1% – 5.8%

EUR16.8 – 17.3 US$15.2 – 21.02

BW: 5.8%

BW: 7.75% BG: 5.8% Entrepo: 15.5%

BW:4.0% – 16.6%

BG: 3.8% – 32.0% Entrepo: 15.5% – 21.5%

3 – 360 mth

N/A

BW: 5.1% – 10.4%

2019

Financial assets at fair value through profit or loss and at fair value through other comprehensive income

Treasury bills

Government stock Unit trust investments

– OTC currency options Other debt securities

– Corporate bonds

Income approach*

Income approach* Market approach**

Income approach*

Income approach*

Note 1

Note 1 Note 4

Note 1 Note 1

Note 1

Note 2 Note 3

Note 1 Note 1

BW: 6.8% – 7.9% BG: 1.2% – 1.5%

BW & Entrepo: 7.3% – 9.9% BW: 7.1% – 7.7% EUR16.3 – 17.1 US$13.6 – 17.6

BW: 8.9%

BW: 10.5% BG: 6.5% CB: 12.0% and 29.8 % Entrepo: 21.5% BW: 6.3% – 19.7% BG: 4.5% – 32.0% CB: 0.0% – 30.5% Entrepo: 18.5% – 21.5% 3 – 360 mth

BW: 7.9% – 10.7% CB: 13.6% – 20.9% BW: 7.5% – 15.2% CB: 16.0% – 25.5%

Financial assets for which the fair value is disclosed

Loans and advances to customers

– Discount rate

– Earnings rate

– Term to maturity

Financial assets at amortised cost

Treasury bills Government stock

Income approach*

Income approach* Income approach*

205