Page 208 - Capricorn IAR 2020

P. 208

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

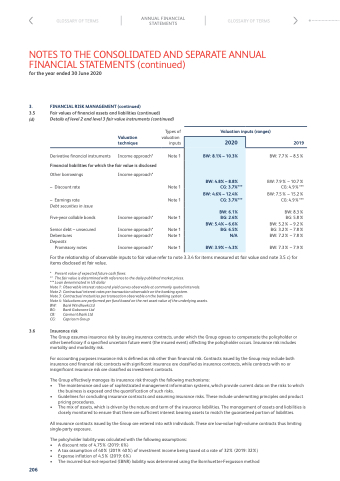

3. FINANCIAL RISK MANAGEMENT (continued)

3.5 Fair values of financial assets and liabilities (continued)

(d) Details of level 2 and level 3 fair value instruments (continued)

Valuation technique

Derivative financial instruments Income approach*

Financial liabilities for which the fair value is disclosed

Types of valuation

inputs

Note 1

Note 1 Note 1

Note 1

Note 1 Note 1

Note 1

Valuation inputs (ranges)

2020

BW: 8.1% – 10.3%

BW: 4.8% – 8.8% CG: 3.7%***

BW: 4.6% – 12.4% CG: 3.7%***

BW: 6.1% BG: 2.6%

BW: 5.4% – 6.6% BG: 6.5%

N/A

BW: 3.9% – 4.3%

Other borrowings

– Discount rate

– Earnings rate

Debt securities in issue

Five-year callable bonds

Senior debt – unsecured Debentures

Deposits

Promissory notes

Income approach*

Income approach*

Income approach* Income approach*

Income approach*

BW: 7.7% – 8.5%

BW: 7.9% – 10.7% CG: 4.9%***

BW: 7.5% – 15.2% CG: 4.9%***

BW: 8.3% BG: 5.8% BW: 5.2% – 9.2% BG: 3.2% – 7.8% BW: 7.2% – 7.8%

BW: 7.3% – 7.9%

For the relationship of observable inputs to fair value refer to note 3.3.4 for items measured at fair value and note 3.5 c) for items disclosed at fair value.

* Present value of expected future cash flows.

** Thefairvalueisdeterminedwithreferencetothedailypublishedmarketprices. *** Loan denominated in US dollar

Note 1: Note 2: Note 3: Note 4: BW: BG: CB: CG:

Observable interest rates and yield curves observable at commonly quoted intervals. Contractual interest rates per transaction observable on the banking system. Contractual maturities per transaction observable on the banking system.

Valuations are performed per fund based on the net asset value of the underlying assets. Bank Windhoek Ltd

Bank Gaborone Ltd Cavmont Bank Ltd Capricorn Group

3.6 Insurance risk

The Group assumes insurance risk by issuing insurance contracts, under which the Group agrees to compensate the policyholder or other beneficiary if a specified uncertain future event (the insured event) affecting the policyholder occurs. Insurance risk includes mortality and morbidity risk.

For accounting purposes insurance risk is defined as risk other than financial risk. Contracts issued by the Group may include both insurance and financial risk; contracts with significant insurance are classified as insurance contracts, while contracts with no or insignificant insurance risk are classified as investment contracts.

The Group effectively manages its insurance risk through the following mechanisms:

• The maintenance and use of sophisticated management information systems, which provide current data on the risks to which

the business is exposed and the quantification of such risks.

• Guidelines for concluding insurance contracts and assuming insurance risks. These include underwriting principles and product

pricing procedures.

• The mix of assets, which is driven by the nature and term of the insurance liabilities. The management of assets and liabilities is

closely monitored to ensure that there are sufficient interest bearing assets to match the guaranteed portion of liabilities.

All insurance contracts issued by the Group are entered into with individuals. These are low-value high-volume contracts thus limiting single-party exposure.

The policyholder liability was calculated with the following assumptions:

• A discount rate of 4.75% (2019: 6%)

• A tax assumption of 40% (2019: 40%) of investment income being taxed at a rate of 32% (2019: 32%)

• Expense inflation of 4.5% (2019: 6%)

• The incurred-but-not-reported (IBNR) liability was determined using the Bornhuetter-Fergusson method

206

2019