Page 209 - Capricorn IAR 2020

P. 209

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.7 Capital management

The Group’s objectives when managing capital, which is a broader concept than the ‘equity’ on the face of the statement of financial position, are to:

• Comply with the capital requirements set by the regulators of the banking markets where the entities within the Group operate

• Safeguard the Group’s ability to continue as a going concern so that it can continue to provide returns for shareholders and

benefits for other stakeholders

• Maintain a strong capital base to support the development of its business

Capital management for the banking group

The Bank of Namibia requires each bank or banking group to maintain the following capital adequacy ratios:

• Tier 1 capital to total assets, as reported in the statutory return, at a minimum of 6%, referred to as the leverage capital ratio

• Tier 1 capital to risk-weighted assets at a minimum of 7%, referred to as Tier 1 risk-based capital ratio

• Total regulatory capital to risk-weighted assets at a minimum of 10%, referred to as total risk-based capital ratio

The Group’s regulatory capital is divided into three tiers:

• Tier 1 capital: share capital (net of any book values of the treasury shares, if any), non-controlling interest arising on

consolidation from interests in permanent shareholders’ equity, retained earnings and reserves created by appropriations of

retained earnings. The book value of goodwill is deducted in arriving at Tier 1 capital

• Tier 2 capital: qualifying subordinated loan capital and collective impairment allowances

• Tier 3 capital: includes short-term subordinated debt that may be used only to cover a portion of the banking institution’s

capital charges for market risk

The Bank of Namibia has adopted a standardised approach to Basel II, with risk-weighted assets being measured at three different levels, operational risk, market risk and credit risk.

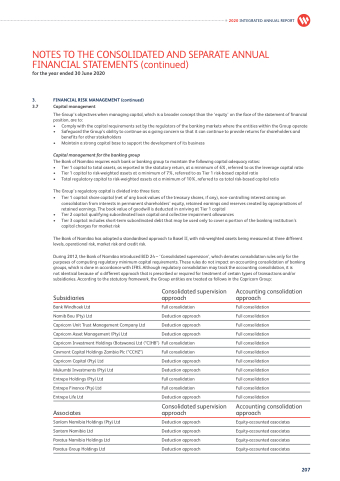

During 2012, the Bank of Namibia introduced BID 24 – ‘Consolidated supervision’, which denotes consolidation rules only for the purposes of computing regulatory minimum capital requirements. These rules do not impact on accounting consolidation of banking groups, which is done in accordance with IFRS. Although regulatory consolidation may track the accounting consolidation, it is

not identical because of a different approach that is prescribed or required for treatment of certain types of transactions and/or subsidiaries. According to the statutory framework, the Group entities are treated as follows in the Capricorn Group:

Subsidiaries

Bank Windhoek Ltd

Namib Bou (Pty) Ltd

Capricorn Unit Trust Management Company Ltd

Capricorn Asset Management (Pty) Ltd

Capricorn Investment Holdings (Botswana) Ltd (“CIHB”)

Cavmont Capital Holdings Zambia Plc (“CCHZ”)

Capricorn Capital (Pty) Ltd

Mukumbi Investments (Pty) Ltd

Entrepo Holdings (Pty) Ltd

Entrepo Finance (Pty) Ltd

Entrepo Life Ltd

Associates

Sanlam Namibia Holdings (Pty) Ltd

Santam Namibia Ltd

Paratus Namibia Holdings Ltd

Paratus Group Holdings Ltd

Consolidated supervision approach

Full consolidation

Deduction approach

Deduction approach

Deduction approach

Full consolidation

Full consolidation

Deduction approach

Deduction approach

Full consolidation

Full consolidation

Deduction approach

Consolidated supervision approach

Deduction approach

Deduction approach

Deduction approach

Deduction approach

Accounting consolidation approach

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Full consolidation

Accounting consolidation approach

Equity-accounted associates

Equity-accounted associates

Equity-accounted associates

Equity-accounted associates

207