Page 210 - Capricorn IAR 2020

P. 210

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.7 Capital management (continued)

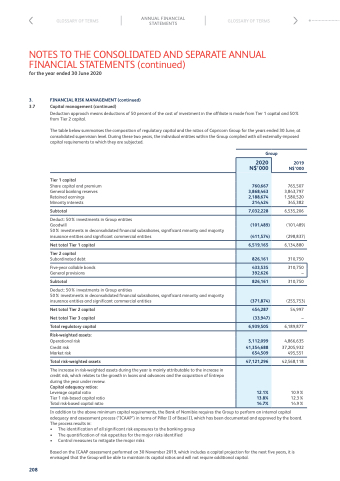

Deduction approach means deductions of 50 percent of the cost of investment in the affiliate is made from Tier 1 capital and 50% from Tier 2 capital.

The table below summarises the composition of regulatory capital and the ratios of Capricorn Group for the years ended 30 June, at consolidated supervision level. During these two years, the individual entities within the Group complied with all externally-imposed capital requirements to which they are subjected.

Tier 1 capital

Share capital and premium General banking reserves Retained earnings Minority interests

Subtotal

Deduct: 50% investments in Group entities

Goodwill

50% investments in deconsolidated financial subsidiaries, significant minority and majority insurance entities and significant commercial entities

Net total Tier 1 capital Tier 2 capital

Subordinated debt

Five-year callable bonds General provisions

Subtotal

Deduct: 50% investments in Group entities

50% investments in deconsolidated financial subsidiaries, significant minority and majority insurance entities and significant commercial entities

Net total Tier 2 capital Net total Tier 3 capital Total regulatory capital

Risk-weighted assets:

Operational risk Credit risk Market risk

Total risk-weighted assets

The increase in risk-weighted assets during the year is mainly attributable to the increase in credit risk, which relates to the growth in loans and advances and the acquisition of Entrepo during the year under review.

Capital adequacy ratios:

Leverage capital ratio

Tier 1 risk-based capital ratio Total risk-based capital ratio

Group

2020 N$’000

760,667 3,868,463 2,188,674

214,424

7,032,228

(101,489) (411,574)

6,519,165

826,161

433,535 392,626

826,161

(371,874)

454,287 (33,947)

6,939,505

5,112,099 41,354,688 654,509

47,121,296

12.1% 13.8% 14.7%

2019 N$’000

765,507 3,843,797 1,580,520

345,382

6,535,206

(101,489) (298,837)

6,134,880

310,750

310,750

(255,753)

54,997 –

6,189,877

4,866,635 37,205,932 495,551

42,568,118

10.9% 12.3% 14.9%

208

In addition to the above minimum capital requirements, the Bank of Namibia requires the Group to perform an internal capital adequacy and assessment process (“ICAAP”) in terms of Pillar II of Basel II, which has been documented and approved by the board. The process results in:

• The identification of all significant risk exposures to the banking group

• The quantification of risk appetites for the major risks identified

• Control measures to mitigate the major risks

Based on the ICAAP assessment performed on 30 November 2019, which includes a capital projection for the next five years, it is envisaged that the Group will be able to maintain its capital ratios and will not require additional capital.

310,750 –