Page 23 - Capricorn IAR 2020

P. 23

2020 INTEGRATED ANNUAL REPORT

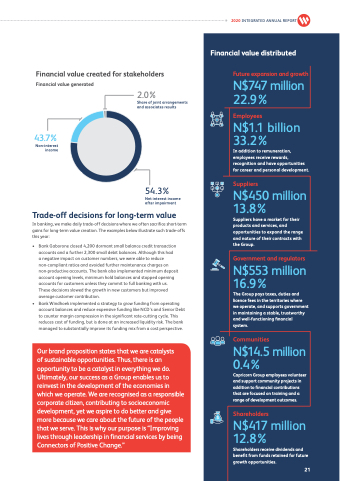

Financial value created for stakeholders Financial value generated

2.0%

Share of joint arrangements and associates results

43.7%

Non-interest income

Trade-off decisions for long-term value

In banking, we make daily trade-off decisions where we often sacrifice short-term gains for long-term value creation. The examples below illustrate such trade-offs this year:

• Bank Gaborone closed 4,200 dormant small balance credit transaction accounts and a further 2,300 small debit balances. Although this had

a negative impact on customer numbers, we were able to reduce non-compliant ratios and avoided further maintenance charges on non-productive accounts. The bank also implemented minimum deposit account opening levels, minimum hold balances and stopped opening accounts for customers unless they commit to full banking with us. These decisions slowed the growth in new customers but improved average customer contribution.

• Bank Windhoek implemented a strategy to grow funding from operating account balances and reduce expensive funding like NCD’s and Senior Debt to counter margin compression in the significant rate-cutting cycle. This reduces cost of funding, but is done at an increased liquidity risk. The bank managed to substantially improve its funding mix from a cost perspective.

Our brand proposition states that we are catalysts

of sustainable opportunities. Thus, there is an opportunity to be a catalyst in everything we do. Ultimately, our success as a Group enables us to reinvest in the development of the economies in which we operate. We are recognised as a responsible corporate citizen, contributing to socioeconomic development, yet we aspire to do better and give more because we care about the future of the people that we serve. This is why our purpose is “Improving lives through leadership in financial services by being Connectors of Positive Change.”

54.3%

Net interest income after impairment

Financial value distributed

Future expansion and growth

N$747 million 22.9%

Employees

N$1.1 billion 33.2%

In addition to remuneration, employees receive rewards, recognition and have opportunities for career and personal development.

Suppliers

N$450 million 13.8%

Suppliers have a market for their products and services, and opportunities to expand the range and nature of their contracts with the Group.

Government and regulators

N$553 million 16.9%

The Group pays taxes, duties and licence fees in the territories where we operate, and supports government in maintaining a stable, trustworthy and well-functioning financial system.

Communities

N$14.5 million 0.4%

Capricorn Group employees volunteer and support community projects in addition to financial contributions that are focused on training and a range of development outcomes.

Shareholders

N$417 million 12.8%

Shareholders receive dividends and benefit from funds retained for future growth opportunities.

21