Page 142 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 142

r

137

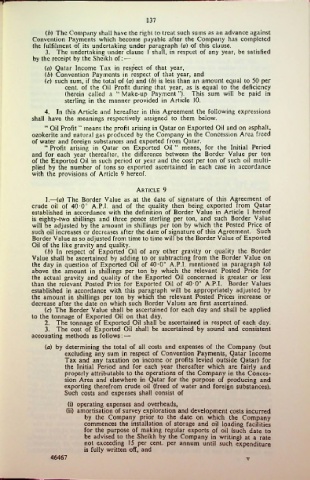

(/;) The Company shall have the right to treat such sums as an advance against

Convention Payments which become payable after the Company has completed

the fulfilment of its undertaking under paragraph (a) of this clause.

3. The undertaking under clause 1 shall, in respect of any year, be satisfied

by the receipt by the Sheikh of: —

(a) Qatar Income Tax in respect of that year,

(b) Convention Payments in respect of that year, and

(c) such sum, if the total of (a) and (b) is less than an amount equal to 50 per

cent, of the Oil Profit during that year, as is equal to the deficiency

(herein called a “ Make-up Payment ”). This sum will be paid in

sterling in the manner provided in Article 10.

4. In this Article and hereafter in this Agreement the following expressions

shall have the meanings respectively assigned to them below.

“ Oil Profit ” means the profit arising in Qatar on Exported Oil and on asphalt,

ozokerite and natural gas produced by the Company in the Concession Area freed

of water and foreign substances and exported from Qatar.

“ Profit arising in Qatar on Exported Oil ” means, for the Initial Period

and for each year thereafter, the difference between the Border Value per ton

of the Exported Oil in such period or year and the cost per ton of such oil multi

plied by the number of tons so exported ascertained in each case in accordance

with the provisions of Article 9 hereof.

Article 9

1. —(a) The Border Value as at the date of signature of this Agreement of

-

crude oil of 40-0° A.P.I. and of the quality then being exported from Qatar

established in accordance with the definition of Border Value in Article 1 hereof

is eighty-two shillings and three pence sterling per ton, and such Border Value

will be adjusted by the amount in shillings per ton by which the Posted Price of

such oil increases or decreases after the date of signature of this Agreement. Such

Border Value as so adjusted from time to time will be the Border Value of Exported

Oil of the like gravity and quality.

(b) In respect of Exported Oil of any other gravity or quality the Border

Value shall be ascertained by adding to or subtracting from the Border Value on

the day in question of Exported Oil of 40-0° A.P.I. mentioned in paragraph (n)

above the amount in shillings per ton by which the relevant Posted Price for

the actual gravity and quality of the Exported Oil concerned is greater or less

than the relevant Posted Price for Exported Oil of 40*0° A.P.I. Border Values

established in accordance with this paragraph will be appropriately adjusted by

the amount in shillings per ton by which the relevant Posted Prices increase or

decrease after the date on which such Border Values are first ascertained.

(c) The Border Value shall be ascertained for each day and shall be applied

to the tonnage of Exported Oil on that day.

2. The tonnage of Exported Oil shall be ascertained in respect of each day.

3. The cost of Exported Oil shall be ascertained by sound and consistent

accounting methods as follows: —

(a) by determining the total of all costs and expenses of the Company (but

excluding any sum in respect of Convention Payments, Qatar Income

Tax and any taxation on income or profits levied outside Qatar) for

the Initial Period and for each year thereafter which are fairly and

properly attributable to the operations of the Company in the Conces

sion Area and elsewhere in Qatar for the purpose of producing and

exporting therefrom crude oil (freed of water and foreign substances).

Such costs and expenses shall consist of

(i) operating expenses and overheads,

(ii) amortisation of survey exploration and development costs incurred

by the Company prior to the date on which the Company

commences the installation of storage and oil loading facilities

for the purpose of making regular exports of oil (such date to

be advised to the Sheikh by the Company in writing) at a rate

not exceeding 15 per cent, per annum until such expenditure

is fully written off, and

46467 T