Page 138 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 138

133

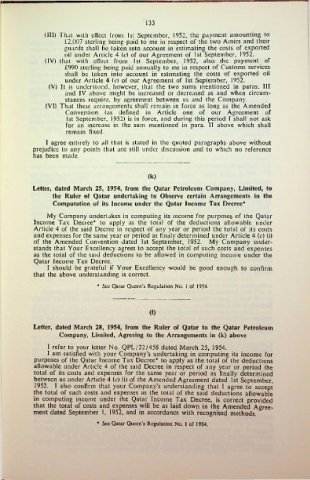

(III) That with effect from 1st September, 1952, the payment amounting to

£2,007 sterling being paid to me in respect of the two Amirs and their

guards shall be taken into account in estimating the costs of exported

oil under Article 4 (c) of our Agreement of 1st September, 1952.

(IV) that with effect from 1st September, 1952, also the payment of

£990 sterling being paid annually to me in respect of Customs services

shall be taken into account in estimating the costs of exported oil

under Article 4 (c) of our Agreement of 1st September, 1952.

(V) It is understood, however, that the two sums mentioned in paras. Ill

and IV above might be increased or decreased as and when circum

stances require, by agreement between us and the Company.

(VI) That these arrangements shall remain in force as long as the Amended

Convention (as defined in Article one of our Agreement of

1st September, 1952) is in force, and during this period I shall not ask

for an increase in the sum mentioned in para. II above which shall

remain fixed.

I agree entirely to all that is stated in the quoted paragraphs above without

prejudice to any points that are still under discussion and to which no reference

has been made.

00

Letter, dated March 25, 1954, from the Qatar Petroleum Company, Limited, to

the Ruler of Qatar undertaking to Observe certain Arrangements in the

Computation of its Income under the Qatar Income Tax Decree*

My Company undertakes in computing its income for purposes of the Qatar

Income Tax Decree* to apply as the total of the deductions allowable under

Article 4 of the said Decree in respect of any year or period the total of its costs

and expenses for the same year or period as finaly determined under Article 4 (c) (i)

of the Amended Convention dated 1st September, 1952. My Company under

stands that Your Excellency agrees to accept the total of such costs and expenses

as the total of the said deductions to be allowed in computing income under the

Qatar Income Tax Decree.

I should be grateful if Your Excellency would be good enough to confirm

that the above understanding is correct.

* See Qatar Queen’s Regulation No. 1 of 1954.

(1)

Letter, dated March 28, 1954, from the Ruler of Qatar to the Qatar Petroleum

Company, Limited, Agreeing to the Arrangements in (k) above

I refer to your letter No. QPL/22/458 dated March 25, 1954.

I am satisfied with your Company’s undertaking in computing its income for

purposes of the Qatar Income Tax Decree* to apply as the total of the deductions

allowable under Article 4 of the said Decree in respect of any year or period the

total of its costs and expenses for the same year or period as finally determined

between us under Article 4 (c) (i) of the Amended Agreement dated 1st September,

1952. I also confirm that your Company’s understanding that I agree to accept

the total of such costs and expenses as the total of the said deductions allowable

in computing income under the Qatar Income Tax Decree, is correct provided

that the total of costs and expenses will be as laid down in the Amended Agree

ment dated September 1, 1952, and in accordance with recognised methods.

♦ See Qatar Queen’s Regulation No. 1 of 1954.