Page 151 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 151

T*

146

(d)

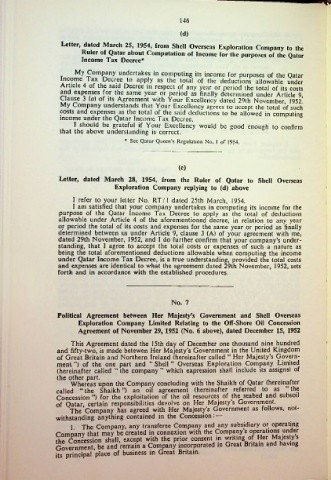

Letter, dated March 25, 1954, from Shell Overseas Exploration Company to the

Ruler of Qatar about Computation of Income for the purposes of the Qatar

Income Tax Decree*

My Company undertakes in computing its income for purposes of the Qatar

u1^0 app,y as thc totaI of the deductions allowable under

Article 4 of the said Decree in respect of any year or period thc total of its costs

and expenses for thc same year or period as finally determined under Article 9

Clause 3 (a) of its Agreement with Your Excellency dated 29th November, 1952.

My Company understands that Your Excellency agrees to accept the total of such

costs and expenses as the total of thc said deductions to be allowed in computing

income under thc Qatar Income Tax Decree.

I should be grateful if Your Excellency would be good enough to confirm

that the above understanding is correct.

* See Qatar Queen’s Regulation No. 1 of 1954.

(C)

Letter, dated March 28, 1954, from the Ruler of Qatar to Shell Overseas

Exploration Company replying to (d) above

I refer to your letter No. RT/1 dated 25th March, 1954.

I am satisfied that your company undertakes in computing its income for the

purpose of the Qatar Income Tax Decree to apply as the total of deductions

allowable under Article 4 of the aforementioned decree, in relation to any year

or period the total of its costs and expenses for the same year or period as finally

determined between us under Article 9, clause 3 (A) of your agreement with me,

dated 29th November, 1952, and I do further confirm that your company’s under

standing, that I agree to accept the total costs or expenses of such a nature as

being the total aforementioned deductions allowable when computing the income

under Qatar Income Tax Decree, is a true understanding, provided the total costs

and expenses are identical to what the agreement dated 29th November, 1952, sets

forth and in accordance with the established procedures.

No. 7

Political Agreement between Her Majesty’s Government and Shell Overseas

Exploration Company Limited Relating to the Off-Shore Oil Concession

Agreement of November 29, 1952 (No. 6 above), dated December 15, 1952

This Agreement dated the 15th day of December one thousand nine hundred

and fifty-two, is made betewen Her Majesty’s Government in the United Kingdom

of Great Britain and Northern Ireland (hereinafter called “ Her Majesty’s Govern

ment ”) of the one part and “ Shell ” Overseas Exploration Company Limited

(hereinafter called “ the company ” which expression shall include its assigns) of

Whereas upon the Company concluding with the Shaikh of Qatar (hereinafter

called “ the Shaikh ”) an oil agreement (hereinafter referred to as “ the

Concession ”) for the exploitation of the oil resources of the seabed and subsoil

of Qatar, certain responsibilities devolve on Her Majesty’s Government.

The Company has agreed with Her Majesty’s Government as follows, not

withstanding anything contained in the Concession: —

1 The Company, any transferee Company and any subsidiary or operating

Government, be and remain a Company incorporated in Great Britain and having

its principal place of business in Great Britain.