Page 133 - The Persian Gulf Historical Summaries (1907-1953) Vol III_Neat

P. 133

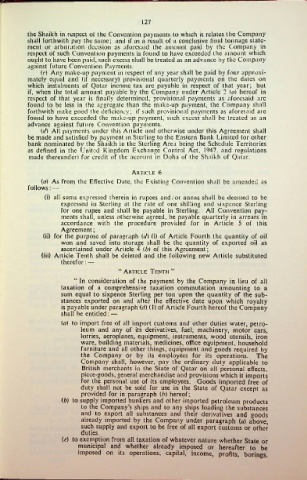

127

the Shaikh in respect of the Convention payments to which it relates the Company

shall forthwith pay the same; and if as a result of a conclusive final tonnage state

ment or arbitration decision as aforesaid the amount paid by the Company in

respect of such Convention payments is found to have exceeded the amount which

ought to have been paid, such excess shall be treated as an advance by the Company

against future Convention Payments.

(c) Any make-up payment in respect of any year shall be paid by four approxi

mately equal and (if necessary) provisional quarterly payments on the dates on

which instalments of Qatar income tax arc payable in respect of that year; but

if, when the total amount payable by the Company under Article 2 (a) hereof in

respect of that year is finally determined, provisional payments as aforesaid arc

found to be less in the aggregate than the make-up payment, the Company shall

forthwith make good the deficiency; if such provisional payments as aforesaid are

found to have exceeded the make-up payment, such excess shall be treated as an

advance against future Convention payments.

(d) All payments under this Article and otherwise under this Agreement shall

be made and satisfied by payment in Sterling to the Eastern Bank Limited (or other

bank nominated by the Shaikh in the Sterling Area being the Schedule Territories

as defined in the United Kingdom Exchange Control Act, 1947. and regulations

made thereunder) for credit of the account in Doha of the Shaikh of Qatar.

Article 6

(«) As from the Effective Date, the Existing Convention shall be amended as

follows: —

(i) all sums expressed therein in rupees and/or annas shall be deemed to be

expressed in Sterling at the rate of one shilling and sixpence Sterling

for one rupee and shall be payable in Sterling. All Convention pay

ments shall, unless otherwise agreed, be payable quarterly in arrears in

accordance with the procedure provided for in Article 5 of this

Agreement;

(ii) for the purpose of paragraph (d) (i) of Article Fourth the quantity of oil

won and saved into storage shall be the quantity of exported oil as

ascertained under Article 4 ib) of this Agreement;

(iii) Article Tenth shall be deleted and the following new Article substituted

therefor: —

“ Article Tenth ”

“ In consideration of the payment by the Company in lieu of all

taxation of a comprehensive taxation commutation amounting to a

sum equal to sixpence Sterling per ton upon the quantity of the sub

stances exported on and after the effective date upon which royalty

is payable under paragraph {d) (1) of Article Fourth hereof the Company

shall be entitled: —

(a) to import free of all import customs and other duties water, petro

leum and any of its derivatives, fuel, machinery, motor cars,

lorries, aeroplanes, equipment, instruments, wood utensils, iron

ware, building materials, medicines, office equipment, household

furniture and all other things, equipment and goods required by

the Company or by its employees for its operations. The

Company shall, however, pay the ordinary duty applicable to

British merchants in the State of Qatar on all personal effects,

piece-goods, general merchandise and provisions which it imports

for the personal use of its employees. Goods imported free of

duty shall not be sold for use in the State of Qatar except as

provided for in paragraph (b) hereof;

(b) to supply imported bunkers and other imported petroleum products

to the Company’s ships and to any ships loading the substances

and to export all substances and their derivatives and soods

already imported by the Company under paragraph (a) above,

such supply and export to be free of all export customs or other

duties.

(c) to exemption from all taxation of whatever nature whether State or

municipal and whether already imposed or hereafter to be

imposed on its operations, capital, income, profits, borings.