Page 135 - The Persian Gulf Historical Summaries (1907-1953) Vol III_Neat

P. 135

129

(2) If more than one seller’s posted price is quoted for Qatar crude oil of

the same quality and gravity the simple arithmetic average of all such postings

shall be used.

(3) If any sellers' posted price is quoted for units other than tons,” it shall

be converted to a price per “ ton ” by using the conversion factor (as laid down

in the Institute of Petroleum's ‘‘Tables for measurement of oil ” dated July 1945)

or subsequent revisions thereof applicable to the actual gravity of the crude oil

to which the quotation relates.

(4) “ Posted prices ” shall be rounded off to the nearest one penny per ton; /.<?.,

0-5000r/. to I*4999r/. inclusive shall be considered as \d.

(5) If Platts Oilgram is discontinued or no longer quotes applicable sellers’

posted prices, some other internationally accepted authority shall be used.

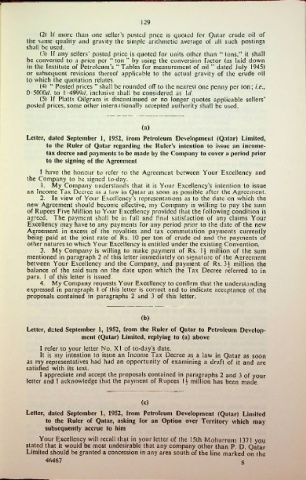

(a)

Letter, dated September 1, 1952, from Petroleum Development (Qatar) Limited,

to the Ruler of Qatar regarding the Ruler’s intention to issue an income-

tax decree and payments to be made by the Company to cover a period prior

to the signing of the Agreement

I have the honour to refer to the Agreement between Your Excellency and

the Company to be signed to-day.

1. My Company understands that it is Your Excellency's intention to issue

an Income Tax Decree as a law in Qatar as soon as possible after the Agreement.

2. In view of Your Excellency’s representations as to the date on which the

new Agreement should become effective, my Company is willing to pay the sum

of Rupees Five Million to Your Excellency provided that the following condition is

agreed. The payment shall be in full and linal satisfaction of any claims Your

Excellency may have to any payments for any period prior to the date of the new

Agreement in excess of the royalties and tax commutation payments currently

being paid at the joint rate of Rs. 10 per ton of crude oil and the payments of

other natures to which Your Excellency is entitled under the existing Convention.

3. My Company is willing to make payment of Rs. R million of the sum

mentioned in paragraph 2 of this letter immediately on signature of the Agreement

between Your Excellency and the Company, and payment of Rs. 3J million the

balance of the said sum on the date upon which the Tax Decree referred to in

para. 1 of this letter is issued.

4. My Company requests Your Excellency to confirm that the understanding

expressed in paragraph 1 of this letter is correct and to indicate acceptance of the

proposals contained in paragraphs 2 and 3 of this letter.

(b)

Letter, dated September 1, 1952, from the Ruler of Qatar to Petroleum Develop

ment (Qatar) Limited, replying to (a) above

I refer to your letter No. XI of to-day's date.

It is my intention to issue an Income Tax Decree as a law in Qatar as soon

as my representatives had had an opportunity of examining a draft of it and are

satisfied with its text.

I appreciate and accept the proposals contained in paragraphs 2 and 3 of your

letter and I acknowledge that the payment of Rupees I V million has been made.

(c)

Letter, dated September 1, 1952, from Petroleum Development (Qatar) Limited

to the Ruler of Qatar, asking for an Option over Territory which may

subsequently accrue to him

Your Excellency will recall that in your letter of the 15th Mohurrum 1371 you

stated that it would be most undesirable that any company other than P. D. Qatar

Limited should be granted a concession in any area south of the line marked on the

46467 s