Page 168 - Bahrain Gov Annual Reports (III)_Neat

P. 168

30

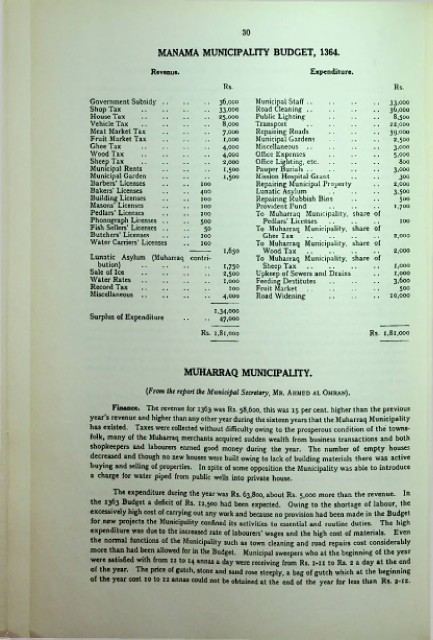

MANAMA MUNICIPALITY BUDGET, 1364.

Revenue. Expenditure.

Rs. Rs.

Government Subsidy . 36.000 Municipal Staff...................... . 33.ooo

Shop Tax 33.000 Road Cleaning .. . 36,000

House Tax 25.000 Public Lighting . 8,500

Vehicle Tax 8.000 Transport ...................... . 22.000

Meat Market Tax 7.000 Repairing Roads 39.000

Fruit Market Tax 1.000 Municipal Gardens 2,500

Ghee Tax 4.000 Miscellaneous .. 3.000

Wood Tax 4.000 Office Expenses 5.000

Sheep Tax 2.000 Office Lighting, etc. 800

Municipal Rents 1.500 Pauper Burials...................... 3.000

Municipal Garden 1.500 Mission Hospital Grant 300

Barbers' Licenses 100 Repairing Municipal Property 2,000

Bakers’ Licenses 400 Lunatic Asylum 3.5oo

Building Licenses 100 Repairing Rubbish Bins 500

Masons' Licenses 100 Provident Fund 1,700

Pedlars’ Licenses 200 To Muharraq Municipality, share of

Phonograph Licenses . 500 Pedlars’ Licenses........................ 100

Fish Sellers’ Licenses . 50 To Muharraq Municipality, share of

Butchers’ Licenses 100 Ghee Tax ................................... 2,000

Water Carriers’ Licenses 100 To Muharraq Municipality, share of

1.650 Wood Tax................................... 2,000

Lunatic Asylum (Muharraq contri To Muharraq Municipality, share of

bution) ................................. i.75o Sheep Tax................................... 1,000

Sale of Ice ................................. 2,500 Upkeep of Sewers and Drains 1,000

Water Rates................................. 1,000 Feeding Destitutes 3.600

Record Tax ................................. 100 Fruit Market................................... 500

Miscellaneous................................. 4.000 Road Widening ........................ 10,000

1,34,000

Surplus of Expenditure 47,000

Rs. 1,81,000 Rs. 1,81.000

MUHARRAQ MUNICIPALITY.

(From the report the Municipal Secretary, Mr. Ahmed al Omran).

Finance. The revenue for 1363 was Rs. 58,600, this was 15 per cent, higher than the previous

year’s revenue and higher than any other year during the sixteen years that the Muharraq Municipality

has existed. Taxes were collected without difficulty owing to the prosperous condition of the towns

folk, many of the Muharraq merchants acquired sudden wealth from business transactions and both

shopkeepers and labourers earned good money during the year. The number of empty houses

decreased and though no new houses were built owing to lack of building materials there was active

buying and selling of properties. In spite of some opposition the Municipality was able to introduce

a charge for water piped from public wells into private house.

The expenditure during the year was Rs. 63,800, about Rs. 5,000 more than the revenue. In

the 1363 Budget a deficit of Rs. 12,500 had been expected. Owing to the shortage of labour, the

excessively high cost of carrying out any work and because no provision had been made in the Budget

for .npw projects the Municipality confined its activities to essential and routine duties. The high

expenditure was due to the increased rate of labourers’ wages and the high cost of materials. Even

the normal functions of the Municipality such as town cleaning and road repairs cost considerably

more than had been allowed for in the Budget. Municipal sweepers who at the beginning of the year

were satisfied with from 12 to 14 annas a day were receiving from Rs. 1-11 to Rs. 2 a day at the end

of the year. The price of gutch, stone and sand rose steeply, a bag of gutch which at the beginning

of the year cost 10 to 12 annas could not be obtained at the end of the year for less than Rs. 2-12.