Page 170 - Bahrain Gov Annual Reports (III)_Neat

P. 170

32

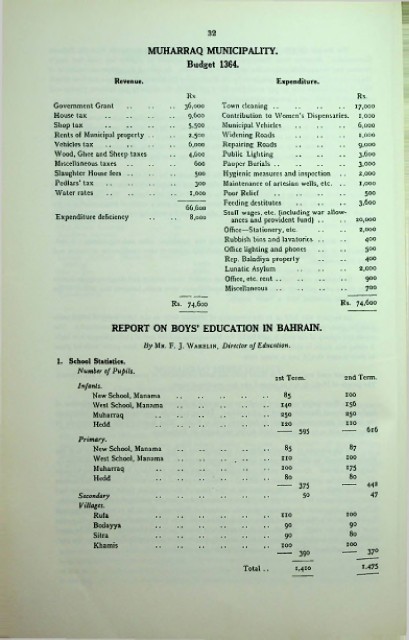

MUHARRAQ MUNICIPALITY.

Budget 1364.

Revenue. Expenditure.

Rs. Rs.

Government Grant 36,000 Town cleaning...................................... 17,000

House tax 9.600 Contribution to Women’s Dispensaries. 1.000

Shop tax 5.500 Municipal Vehicles 6.000

Rents of Municipal property 2.500 Widening Roads 1.000

Vehicles tax 6,000 Repairing Roads .......................... 9.000

Wood, Ghee and Sheep taxes 4.600 Public Lighting .......................... 3.600

Miscellaneous taxes 600 Pauper Burials...................................... 3.000

Slaughter House fees .. 500 Hygienic measures and inspection 2.000

Pedlars’ tax 300 Maintenance of artesian wells, etc. .. 1.000

Water rates 1,000 Poor Relief ...................................... 500

Feeding destitutes .......................... 3.600

66,600

Expenditure deficiency 8,000 Staff wages, etc. (including war allow 20,000

ances and provident fund) ..

Office—Stationery, etc. 2,000

Rubbish bins and lavatories 400

Office lighting and phones 500

Rep. Baladiya property 400

Lunatic Asylum .......................... 2,000

Office, etc. rent...................................... 900

Miscellaneous...................................... 700

Rs. 74,600 Rs. 74,600

REPORT ON BOYS’ EDUCATION IN BAHRAIN.

By Mr. F. J. Wakelin, Director of Education.

1. School Statistics.

Number of Pupils.

1st Term. 2nd Term.

Infants.

New School, Manama 85 100

West School, Manama 140 156

Muharraq 250 250

Hcdd 120 no

595 616

Primary.

New School, Manama 85 87

West School, Manama no 100

Muharraq 100 175

Hedd 80 80

375 442

Secondary 50 47

Villages.

Rufa no 100

Bodayya 90 90

Sitra 90 80

Khamis 100 100

390 37°

Total .. 1,410 1.475