Page 11 - Pancake_Supply_Chain_Co-op_Inc._2016_Annual_Report

P. 11

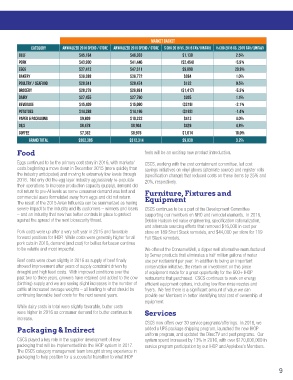

MARKET BASKET

Category Annualized 2016 Spend / Store Annualized 2015 Spend / Store $ Chg 2016 vs. 2015 Fav/(Unfav) % Chg 2016 vs. 2015 Fav/(Unfav)

Beef $45,164 $46,303 $1,139 2.5%

Pork $43,900 $41,446 ($2,454) -5.9%

Eggs $37,412 $47,311 $9,899 20.9%

Bakery $36,388 $36,772 $384 1.0%

Poultry / Seafood $28,341 $28,474 $132 0.5%

Grocery $28,278 $26,861 ($1,417) -5.3%

Dairy $27,455 $27,760 $305 1.1%

Beverage $15,409 $15,090 ($319) -2.1%

Potatoes $14,388 $14,196 ($192) -1.4%

Paper & Packaging $9,809 $10,223 $413 4.0%

Oils $8,478 $8,904 $426 4.8%

Coffee $7,362 $8,976 $1,614 18.0%

Grand Total $302,385 $312,314 $9,930 3.2%

Food feels will be an exciting new product introduction.

Eggs continued to be the primary cost story in 2016, with markets/ CSCS, working with the cost containment committee, led cost

costs beginning a move down in December 2015 (more quickly than savings initiatives on vinyl gloves (alternate source) and register rolls

the industry anticipated) and moving to extremely low levels through (specification change) that reduced costs on these items by 25% and

2016. Not only did the egg layer industry aggressively re-populate 20%, respectively.

their operations to increase production capacity (supply), demand did

not return to pre-AI levels as some consumer demand was lost and Furniture, Fixtures and

commercial users formulated away from eggs and did not return. Equipment

The result of the 2015 Avian Influenza can be summarized as having

severe impact to the industry and its customers – winners and losers CSCS continues to be a part of the Development Committee

– and an industry that now has better controls in place to protect supporting our members on NRO and remodel elements. In 2016,

against the spread of the next biosecurity threat. Debbie Hudson led value engineering, specification rationalization,

and alternate sourcing efforts that removed $16,000 in cost per

Pork costs were up after a very soft year in 2015 and favorable store on 189 Short Stack remodels, and $44,000 per store for 119

forward positions for IHOP. While costs were generally higher for all Full Stack remodels.

pork cuts in 2016, demand (and cost) for bellies for bacon continue

to be volatile and most impactful. We offered the ConserveWell, a dipper well alternative manufactured

by Server products that eliminates a half million gallons of water

Beef costs were down slightly in 2016 as supply of beef finally use per restaurant per year. In addition to being an important

showed improvement after years of supply constraint driven by conservation initiative, the return on investment on this piece

drought and high feed costs. With improved conditions over the of equipment made for a great opportunity for the 600+ IHOP

past two to three years, growers have retained and added to the cow restaurants that purchased. CSCS continues to work on energy

(birthing) supply and we are seeing slight increases in the number of efficient equipment options, including low flow rinse nozzles and

cattle at increased average weights – all leading to what should be fryers. We feel there is a significant amount of value we can

continuing favorable beef costs for the next several years. provide our Members in better identifying total cost of ownership of

equipment.

While dairy costs in total were slightly favorable, butter costs

were higher in 2016 as consumer demand for butter continues to Services

increase.

CSCS now offers over 30 service programs/offerings. In 2016, we

Packaging & Indirect added a UPS package shipping program, launched the new IHOP

uniform program, and updated the DirecTV and pest programs. Our

CSCS played a key role in the supplier development of new system spend increased by 13% in 2016, with over $170,000,000 in

packaging that will be implemented into the IHOP system in 2017. service program participation by our IHOP and Applebee’s Members.

The CSCS category management team brought strong experience in

packaging to help position for a successful transition to what IHOP

9