Page 11 - Apple Supply Chain Co-op Inc. 2016 Annual Report.

P. 11

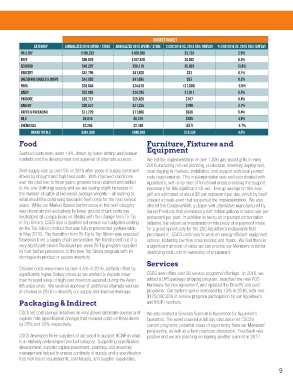

MARKET BASKET

Category Annualized 2016 Spend / Store Annualized 2015 Spend / Store $ Chg 2016 vs. 2015 Fav/(Unfav) % Chg 2016 vs. 2015 Fav/(Unfav)

Poultry $105,252 $108,386 $3,133 2.9%

Beef $96,026 $102,528 $6,502 6.3%

Seafood $43,207 $50,110 $6,903 13.8%

Grocery $41,795 $41,828 $33 0.1%

Dressings Sauces & Soups $41,002 $41,095 $93 0.2%

Pork $35,640 $34,610 ($1,030) -3.0%

Dairy $32,885 $34,795 $1,911 5.5%

Produce $25,721 $25,828 $107 0.4%

Bakery $20,537 $21,335 $799 3.7%

Paper & Packaging $11,229 $11,866 $636 5.4%

Oils $6,010 $6,315 $305 4.8%

Chemicals $2,205 $2,148 ($57) -2.7%

Grand Totals $461,509 $480,843 $19,334 4.0%

Food Furniture, Fixtures and

Seafood costs were down 14%, driven by lower shrimp and salmon Equipment

markets and the development and approval of alternate sources. We led the implementation of over 1,800 gas-assist grills in early

2016, including roll-out planning, production, inventory deployment,

Beef supply was up over 5% in 2016 after years of supply constraint local staging in markets, installation, and support with local permit/

driven by drought and high feed costs. With improved conditions code requirements. This implementation was well-coordinated with

over the past two to three years, growers have retained and added Applebee’s, with a number of functional areas providing the support

to the cow (birthing) supply and we are seeing slight increases in necessary for this significant roll-out. Energy savings on this new

the number of cattle at increased average weights – all leading to grill are estimated at about $8 per restaurant per day, which by itself

what should be continuing favorable beef costs for the next several created a break-even that supported the implementation. We also

years. While our Market Basket performance in the beef category offered the ConserveWell, a dipper well alternative manufactured by

was driven almost exclusively by lower ground chuck costs (we Server Products that eliminates a half million gallons of water use per

neutralized all comparisons on Steaks with the change from Tri-Tip restaurant per year. In addition to being an important conservation

to Top Sirloin), CSCS also outperformed versus our budgeted costing initiative, the return on investment on this piece of equipment made

on the Top Sirloin product that was fully implemented system-wide for a great opportunity for the 250 Applebee’s restaurants that

in May 2016. The transition from Tri-Tip to Top Sirloin was executed purchased it. CSCS continues to work on energy efficient equipment

flawlessly from a supply chain perspective. We transitioned out of a options, including low flow rinse nozzles and fryers. We feel there is

very significant eleven Truckload per week Tri-Tip program supplied a significant amount of value we can provide our Members in better

by four further processors to the new Top Sirloin program with no identifying total cost of ownership of equipment.

shortages in product or excess inventory.

Services

Chicken costs were lower by over 4.5% in 2016, partially offset by

significantly higher Turkey prices as we worked to deplete lower CSCS now offers over 30 service programs/offerings. In 2016, we

than forecast sales of high cost inventory secured during the Avian added a UPS package shipping program, launched the new POS

Influenza crisis. We secured approval of additional alternate sources Hardware Service agreement, and updated the DirecTV and pest

of chicken in 2016 to diversify our supply and improve leverage. programs. Our system spend increased by 13% in 2016, with over

$170,000,000 in service program participation by our Applebee’s

Packaging & Indirect and IHOP members.

CSCS led cost savings initiatives on vinyl gloves (alternate source) and We also hosted a Services Summit in November for Applebee’s

register rolls (specification change) that reduced costs on these items Operators. The event covered a full day discussion on CSCS’s

by 25% and 20% respectively. current programs, potential areas of opportunity from our Members’

perspective, as well as a best practices discussion. Feedback was

CSCS developed three suppliers of cut wood to support HCWF in what positive and we are planning on leading another summit in 2017.

is a relatively undeveloped product category. Supporting specification

development, supplier capital investment, planning, and inventory

management helped to ensure continuity of supply, and a specification

that met brand requirements, cost targets, and supplier capabilities.

9