Page 35 - LITRG_PA-final-2018

P. 35

2

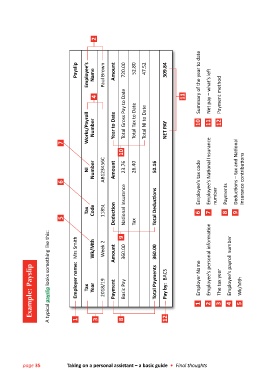

Payslip Employee’s Name Paul Brown Amount 720.00 52.80 47.52 309.84 Summary of the year to date

4 11 Net pay – what’s left Payment method

Works/Payroll Number Year to Date Total Gross Pay to Date Total Tax to Date Total NI to Date NET PAY 10 11 12

7

10

Number AB123456C Amount 23.76 26.40 50.16

NI Employee’s National Insurance Deductions – tax and National

6 Employee’s tax code Insurance contributions

number Payments

Tax Code 1185L National Insurance Total Deductions

Deduction 6 7 8 9

5 Wk/Mth Week 2 Amount 9 360.00 Tax 360.00

Example: Payslip A typical payslip looks something like this: Employer name: Mrs Smith Tax Year 2018/19 Payment Basic Pay Total Payments Pay by: BACS Employer Name 1 Employee’s personal information 2 The tax year 3 Employee’s payroll number 4 Wk/Mth 5

1 3 8 12

page 35 Taking on a personal assistant – a basic guide • Final thoughts