Page 40 - LITRG_PA-final-2018

P. 40

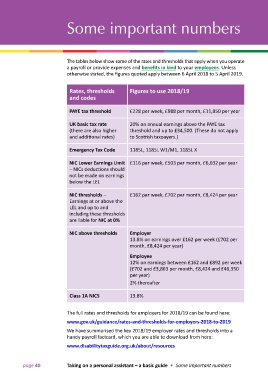

Some important numbers

The tables below show some of the rates and thresholds that apply when you operate

a payroll or provide expenses and benefits in kind to your employees. Unless

otherwise stated, the figures quoted apply between 6 April 2018 to 5 April 2019.

Rates, thresholds Figures to use 2018/19

and codes

PAYE tax threshold £228 per week, £988 per month, £11,850 per year

UK basic tax rate 20% on annual earnings above the PAYE tax

(there are also higher threshold and up to £34,500. (These do not apply

and additional rates) to Scottish taxpayers.)

Emergency Tax Code 1185L, 1185L W1/M1, 1185L X

NIC Lower Earnings Limit £116 per week, £503 per month, £6,032 per year

– NICs deductions should

not be made on earnings

below the LEL

NIC thresholds – £162 per week, £702 per month, £8,424 per year

Earnings at or above the

LEL and up to and

including these thresholds

are liable for NIC at 0%

NIC above thresholds Employer

13.8% on earnings over £162 per week (£702 per

month, £8,424 per year)

Employee

12% on earnings between £162 and £892 per week

(£702 and £3,863 per month, £8,424 and £46,350

per year)

2% thereafter

Class 1A NICS 13.8%

The full rates and thresholds for employers for 2018/19 can be found here:

www.gov.uk/guidance/rates-and-thresholds-for-employers-2018-to-2019

We have summarised the key 2018/19 employer rates and thresholds into a

handy payroll factcard, which you are able to download from here:

www.disabilitytaxguide.org.uk/about/resources

page 40 Taking on a personal assistant – a basic guide • Some important numbers