Page 85 - BIPAR Annual Report 2020_EN short

P. 85

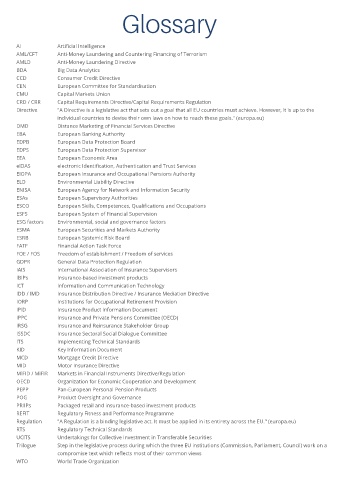

Glossary

AI Artificial Intelligence

AML/CFT Anti-Money Laundering and Countering Financing of Terrorism

AMLD Anti-Money Laundering Directive

BDA Big Data Analytics

Cyber Risk and its Insurance services for two years now. The services delegation met CCD Consumer Credit Directive

several Ambassadors and commercial counsellors of CEN European Committee for Standardisation

During the last two years, the IPPC examined the role WTO members and discussed the state of play of these CMU Capital Markets Union

of insurance in managing cyber risk. The Committee talks and of their support for these initiatives. WFII seized CRD / CRR Capital Requirements Directive/Capital Requirements Regulation

organised a conference on this issue and published a set of the opportunity offered by these bilateral meetings, Directive "A Directive is a legislative act that sets out a goal that all EU countries must achieve. However, it is up to the

recommendations that different stakeholders (businesses, to bring its perspective regarding liberalisation of the individual countries to devise their own laws on how to reach these goals." (europa.eu)

intermediaries, (re)insurance companies and governments) insurance mediation sector and the issue of multinational DMD Distance Marketing of Financial Services Directive

could implement to address the challenges to the cyber placements to the attention of the WTO Ambassadors and EBA European Banking Authority

risk insurance market’s development. WFII contributed to their teams. EDPB European Data Protection Board

this OECD report and participated in the conference as a EDPS European Data Protection Supervisor

panellist. As a next step in this project, the IPPC studied EU-US Insurance Project EEA European Economic Area

the differences in policy and regulatory requirements that eIDAS electronic Identification, Authentication and Trust Services

affect the scope or form of cyber insurance coverage. The EU-US Insurance Project started in early 2012, EIOPA European Insurance and Occupational Pensions Authority

At the December 2019 meeting the initial report was when the European Commission, EIOPA, NAIC (National ELD Environmental Liability Directive

presented in two separate reports, one on claims data Association of Insurance Commissioners) and the FIO ENISA European Agency for Network and Information Security

sharing, the other on insurance coverage issues. (Federal Insurance Office of the US Department of the ESAs European Supervisory Authorities

Treasury) agreed to participate in a deeper dialogue project ESCO European Skills, Competences, Qualifications and Occupations

The institutional structure of insurance regulation and to contribute to an increased mutual understanding and ESFS European System of Financial Supervision

supervision enhanced cooperation between the EU and US to promote ESG factors Environmental, social and governance factors

business opportunity, consumer protection and effective ESMA European Securities and Markets Authority

In 2018 the IPPC published a Report on the institutional supervision in the EU and US. ESRB European Systemic Risk Board

structure of insurance regulation and supervision. Building FATF Financial Action Task Force

on this work, the Committee developed policy guidance The above-mentioned insurance regulators and supervisors FOE / FOS Freedom of establishment / Freedom of services

to complement the IAIS Insurance Core Principles (ICPs) on had the intention to continue their dialogue by organising GDPR General Data Protection Regulation

the objectives, powers and responsibilities of insurance a public event in Washington D.C. in March 2020, related IAIS International Association of Insurance Supervisors

supervisors. This includes guidance on the institutional to cyber security risks, the cyber insurance market and IBIPs Insurance-based investment products

structure of insurance regulation and supervision as well the use of Big Data. A representative of the American ICT Information and Communication Technology

as issues related to the independence and accountability insurance intermediary sector, submitted by WFII to the IDD / IMD Insurance Distribution Directive / Insurance Mediation Directive

and mandates and objectives of insurance regulators and organisers, would have been one of the panellists but due IORP Institutions for Occupational Retirement Provision

supervisors. WFII commented in 2019 on the draft policy to the COVID-19 outbreak this event was cancelled. IPID Insurance Product Information Document

guidance. WFII suggested, among others, to the drafters to IPPC Insurance and Private Pensions Committee (OECD)

give more attention to innovation in the sector. New concepts The 2019 WFII Annual meeting IRSG Insurance and Reinsurance Stakeholder Group

that appeared in the market could be elaborated in the ISSDC Insurance Sectoral Social Dialogue Committee

guidance. WFII also suggested mentioning the consideration Due to the COVID-19 outbreak, the WFII World Council ITS Implementing Technical Standards

that regulation should be based on high-level principles Singapore 2020 meeting in person was cancelled. Instead, KID Key Information Document

and should not be subject to a constant change in order to a WFII General Assembly was held by email and on MCD Mortgage Credit Directive

guarantee stability, and to ensure that the supervisor has the Wednesday 29 April 2020 a video conference took place MID Motor Insurance Directive

time to deliver effective supervision. which was joined by many World Council members and MiFID / MiFIR Markets in Financial Instruments Directive/Regulation

the members of the ExCSE Committee. Mr. Yoshi Kawai, OECD Organization for Economic Cooperation and Development

Activities with the WTO Chairman of the OECD- Insurance and Private Pensions PEPP Pan-European Personal Pension Products

Committee (IPPC) also joined this video conference. Mr POG Product Oversight and Governance

Within the framework of the WTO Public Forum that took Kawai, who would have been a speaker at the WOC 2020 PRIIPs Packaged retail and insurance-based investment products

place in October 2019 in Geneva, WFII joined a delegation Singapore meeting, elaborated in his speech on the OECD REFIT Regulatory Fitness and Performance Programme

of the Global Service Coalition and met several key country note Initial assessment of insurance coverage and gaps Regulation "A Regulation is a binding legislative act. It must be applied in its entirety across the EU." (europa.eu)

negotiators who have been discussing e-commerce, for tackling COVID -19 impacts. RTS Regulatory Technical Standards

investment facilitation and domestic regulation in UCITS Undertakings for Collective Investment in Transferable Securities

Trilogue Step in the legislative process during which the three EU institutions (Commission, Parliament, Council) work on a

compromise text which reflects most of their common views

WTO World Trade Organization

84