Page 8 - Uzbek Outlook 2024

P. 8

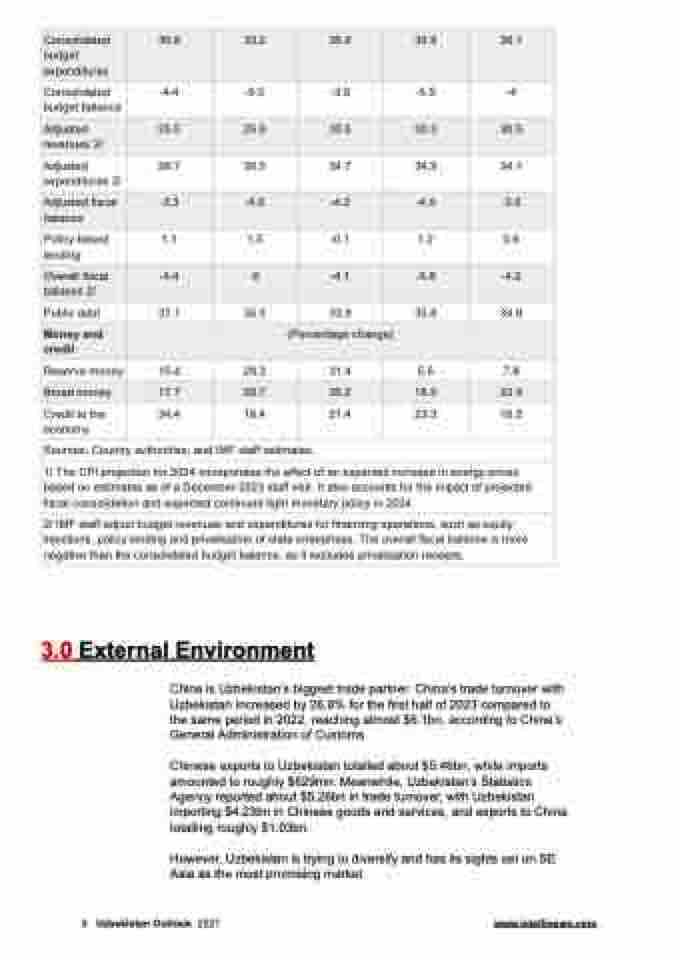

Consolidated budget expenditures

30.8

33.2

35.9

36.9

36.1

Consolidated budget balance

-4.4

-5.5

-3.9

-5.5

-4

Adjusted revenues 2/

25.5

25.9

30.5

30.3

30.5

Adjusted expenditures 2/

28.7

30.5

34.7

34.9

34.1

Adjusted fiscal balance

-3.3

-4.6

-4.2

-4.6

-3.6

Policy-based lending

1.1

1.5

-0.1

1.2

0.6

Overall fiscal balance 2/

-4.4

-6

-4.1

-5.8

-4.2

Public debt

37.1

35.3

33.9

35.8

34.8

Money and credit

(Percentage change)

Reserve money

15.4

28.3

31.4

5.5

7.8

Broad money

17.7

29.7

30.2

18.5

22.4

Credit to the economy

34.4

18.4

21.4

23.3

16.5

Sources: Country authorities; and IMF staff estimates.

1/ The CPI projection for 2024 incorporates the effect of an expected increase in energy prices based on estimates as of a December 2023 staff visit. It also accounts for the impact of projected fiscal consolidation and expected continued tight monetary policy in 2024.

2/ IMF staff adjust budget revenues and expenditures for financing operations, such as equity injections, policy lending and privatisation of state enterprises. The overall fiscal balance is more negative than the consolidated budget balance, as it excludes privatisation receipts.

3.0 External Environment

China is Uzbekistan’s biggest trade partner. China’s trade turnover with Uzbekistan increased by 26.8% for the first half of 2023 compared to the same period in 2022, reaching almost $6.1bn, according to China’s General Administration of Customs.

Chinese exports to Uzbekistan totalled about $5.46bn, while imports amounted to roughly $629mn. Meanwhile, Uzbekistan’s Statistics Agency reported about $5.26bn in trade turnover, with Uzbekistan importing $4.23bn in Chinese goods and services, and exports to China totalling roughly $1.03bn.

However, Uzbekistan is trying to diversify and has its sights set on SE Asia as the most promising market.

8 Uzbekistan Outlook 2021 www.intellinews.com