Page 10 - Ukraine OUTLOOK 2023

P. 10

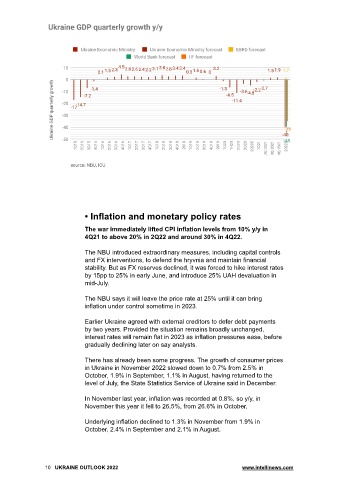

• Inflation and monetary policy rates

The war immediately lifted CPI inflation levels from 10% y/y in

4Q21 to above 20% in 2Q22 and around 30% in 4Q22.

The NBU introduced extraordinary measures, including capital controls

and FX interventions, to defend the hryvnia and maintain financial

stability. But as FX reserves declined, it was forced to hike interest rates

by 15pp to 25% in early June, and introduce 25% UAH devaluation in

mid-July.

The NBU says it will leave the price rate at 25% until it can bring

inflation under control sometime in 2023.

Earlier Ukraine agreed with external creditors to defer debt payments

by two years. Provided the situation remains broadly unchanged,

interest rates will remain flat in 2023 as inflation pressures ease, before

gradually declining later on say analysts.

There has already been some progress. The growth of consumer prices

in Ukraine in November 2022 slowed down to 0.7% from 2.5% in

October, 1.9% in September, 1.1% in August, having returned to the

level of July, the State Statistics Service of Ukraine said in December.

In November last year, inflation was recorded at 0.8%, so y/y, in

November this year it fell to 26.5%, from 26.6% in October.

Underlying inflation declined to 1.3% in November from 1.9% in

October, 2.4% in September and 2.1% in August.

10 UKRAINE OUTLOOK 2022 www.intellinews.com