Page 122 - SE Outlook Regions 2023

P. 122

Under the latest projection from Banca Transilvania, Romania’s private

consumption is seen as decelerating from 7.1% in 2021 to 5.6% in

2022, respectively 3.3% in 2023, given that the high level of inflationary

pressure has an unfavourable impact on households’ real disposable

income.

Private consumption could accelerate to 4.5% in 2024, an evolution

supported by the improvement of the climate in the labour market,

according to Banca Transilvania.

3.9.2 Banks

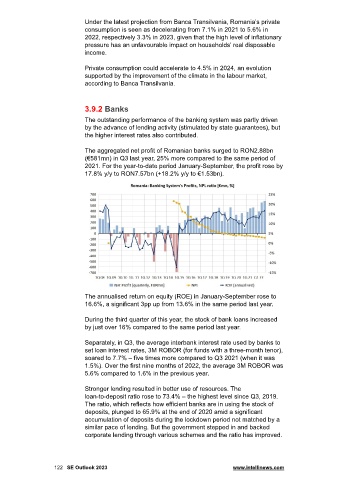

The outstanding performance of the banking system was partly driven

by the advance of lending activity (stimulated by state guarantees), but

the higher interest rates also contributed.

The aggregated net profit of Romanian banks surged to RON2.88bn

(€581mn) in Q3 last year, 25% more compared to the same period of

2021. For the year-to-date period January-September, the profit rose by

17.8% y/y to RON7.57bn (+18.2% y/y to €1.53bn).

The annualised return on equity (ROE) in January-September rose to

16.6%, a significant 3pp up from 13.6% in the same period last year.

During the third quarter of this year, the stock of bank loans increased

by just over 16% compared to the same period last year.

Separately, in Q3, the average interbank interest rate used by banks to

set loan interest rates, 3M ROBOR (for funds with a three-month tenor),

soared to 7.7% – five times more compared to Q3 2021 (when it was

1.5%). Over the first nine months of 2022, the average 3M ROBOR was

5.6% compared to 1.6% in the previous year.

Stronger lending resulted in better use of resources. The

loan-to-deposit ratio rose to 73.4% – the highest level since Q3, 2019.

The ratio, which reflects how efficient banks are in using the stock of

deposits, plunged to 65.9% at the end of 2020 amid a significant

accumulation of deposits during the lockdown period not matched by a

similar pace of lending. But the government stepped in and backed

corporate lending through various schemes and the ratio has improved.

122 SE Outlook 2023 www.intellinews.com