Page 11 - AfrOil Week 31

P. 11

AfrOil PIPELINES & TRANSPORT AfrOil

San Leon Energy acquires 10%

of ACOES oil pipeline operator

NIGERIA IRELAND’S San Leon Energy has taken a 10% disruptions related to the use of NCTL, a 97-km

stake in Malta-based Energy Link Infrastructure pipeline that passes through the Niger River

(ELI), the owner of an oil pipeline network now Delta. The pipeline typically carries 150,000-

under construction in Nigeria. 200,000 bpd of crude oil to a terminal facility

In a statement, San Leon said it had arranged on Bonny Island, but it is frequently targeted by

to pay $15mn for an equity stake in the Alter- vandals and thieves and was taken offline several

native Crude Oil Evacuation System (ACOES), times last year.

which will serve as a dedicated transport route San Leon described ACOES as a safer route

for production from OML 18. This licence area for production from OML 18. The new system

lies mostly onshore south of Port Harcourt. It will have “a significant effect on the operation

contains multiple oilfields and is operated by of OML 18, primarily through the reduction of

Nigeria’s Eroton Exploration & Production. downtime and losses associated with the exist-

According to the statement, San Leon’s pay- ing export route,” it said in the statement.

ment will come in the form of a $15mn share- ACOES will charge fees comparable to the

holder loan carrying a coupon of 14% per year cost of pumping crude through NCTL, it added.

over a period of four years. Following a one-year The company also called the deal with ELI

grace period that will begin on the date of invest- a potential source of profit in the medium

ment, ELI will have to make payments on the and long term. It explained that its 10% stake

loan on a quarterly basis. would entitle it to a portion of the fees that “ELI,

San Leon will disburse the funds in two through its Nigerian subsidiary, will earn … for

tranches and is due to release the first tranche of transporting and storing crude oil from OML 18

$10mn before the end of this week. It will then and potential third parties.”

make the second tranche of $5mn available in Oisin Fanning, San Leon’s CEO, expressed

the fourth quarter of 2020, once Midwestern satisfaction with the acquisition. “We are

Leon Petroleum, another Nigerian company, delighted to make this investment, which is in

makes its next scheduled payment on loan notes. line with our strategy of investing in assets with

When finished, ACOES will consist of a near-term cash flow, where the initial invest-

pipeline with a throughput capacity of 100,000 ment is considered to be of limited risk and

barrels per day (bpd) and a floating storage and where there is material upside,” he said. “The

off-loading (FSO) vessel that can hold 2mn bar- ACOES [network] is expected to generate regu-

rels of crude. It will serve as an alternative to the lar cash flow once commissioned in the coming

existing Nembe Creek Trunk Line (NCTL) and quarters, whilst also providing the significant

will only handle oil from OML 18 fields. benefits to downtime and losses reduction for

The network will allow its users to avoid OML 18.”

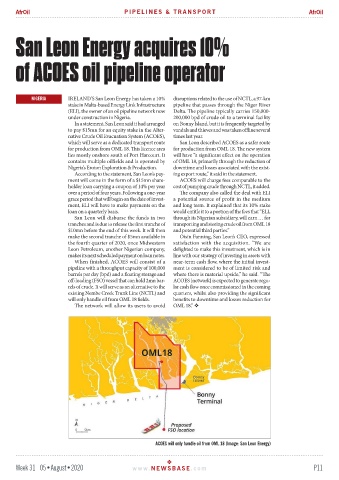

ACOES will only handle oil from OML 18 (Image: San Leon Energy)

Week 31 05•August•2020 www. NEWSBASE .com P11