Page 11 - AfrOil Week 47

P. 11

AfrOil INVESTMENT AfrOil

PetroNor takes control of two

blocks offshore Guinea-Bissau

GUINEA-BISSAU NORWAY’S PetroNor has acquired majority wider effort to expand operations offshore West

stakes in the Sinapa and Esperança blocks off- Africa. “This is a key strategic addition to Petro-

shore Guinea-Bissau through its purchase of Nor’s portfolio, building in this highly attractive

SPE Guinea Bissau, a subsidiary of Sweden’s SPE exploration trend,” he said. “Along with the rein-

(Svenska Petroleum Exploration). stated A4 licence in The Gambia and our acreage

PetroNor announced the takeover of SPE in Senegal, the equity available [for] potential

Guinea Bissau in a statement dated November farm-ins is a highly attractive material opportu-

20. It did not reveal the terms of the deal, but it nity. PetroNor is continuing its work to bring in

did say that it now held 78.57% stakes in and the partners to fund a drilling campaign across all

operatorship of Sinapa, also known as Block 2, assets in the next few years.”

and Esperança, composed of Blocks 4A and 5A.

Additionally, it noted that the government

of Guinea-Bissau had recently extended the

licences for the blocks by another three years.

The licences carry the same terms as before, but

are now due to expire on October 2, 2023, it said.

The company described the two blocks as a

good investment, pointing out that they were

home to two prospects, Atum and Anchova,

that were “analogous to the world-class Sango-

mar field [offshore] Senegal.” These two sites are

believed to contain 568mn barrels of crude oil in

recoverable prospective reserves, and they have

been well prepared for drilling, it stated.

“The prospects are ‘drill ready,’ benefiting

from significant technical work delivered to date

by Svenska Petroleum Exploration and [its Aus-

tralian] partner FAR,” PetroNor explained. It did

not say exactly when it hoped to begin drilling,

but it did indicate that it was beginning a review

of the global rig market with the intent of spud-

ding its first well in 2021 or 2022.

Knut Søvold, the company’s CEO, described

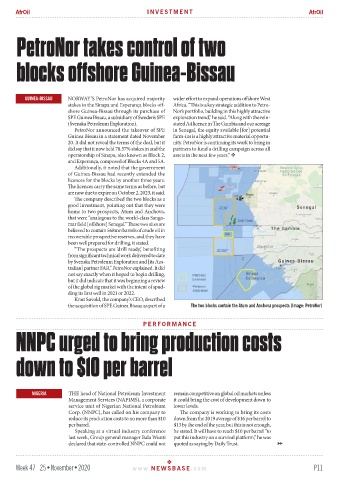

the acquisition of SPE Guinea Bissau as part of a The two blocks contain the Atum and Anchova prospects (Image: PetroNor)

PERFORMANCE

NNPC urged to bring production costs

down to $10 per barrel

NIGERIA THE head of National Petroleum Investment remain competitive on global oil markets unless

Management Services (NAPIMS), a corporate it could bring the cost of development down to

service unit of Nigerian National Petroleum lower levels.

Corp. (NNPC), has called on his company to The company is working to bring its costs

reduce its production costs to no more than $10 down from the 2019 average of $16 per barrel to

per barrel. $13 by the end of the year, but this is not enough,

Speaking at a virtual industry conference he stated. It will have to reach $10 per barrel “to

last week, Group general manager Bala Wunti put this industry on a survival platform,” he was

declared that state-controlled NNPC could not quoted as saying by Daily Trust.

Week 47 25•November•2020 www. NEWSBASE .com P11