Page 71 - bne IntelliNews Russia OUTLOOK 2025

P. 71

complained that with deposit rates over 20% it has become more profitable to deposit cash in a bank than to invest into business.

As followed by bne IntelliNews, amid the key interest rate above 20%, deposits reportedly draw retail investors away from the Russian equity market. The government is also said to be seeking to make deposits less attractive than investment activities for companies in the private sector.

A tax on deposits has been in force in Russia since 2021, but the deadline for its payment was postponed after Moscow launched its full-scale military invasion of Ukraine. As a result, the first year for which the tax is applied is 2023, with tax payments to be made until December 1, 2024.

According to the June 2024 amendments to the budget law, the Ministry of Finance expected to raise RUB101.6bn from the deposit income tax. Thus the amount of tax charged by the Federal Tax Service exceeded the plan by 12% and might still beat expectations.

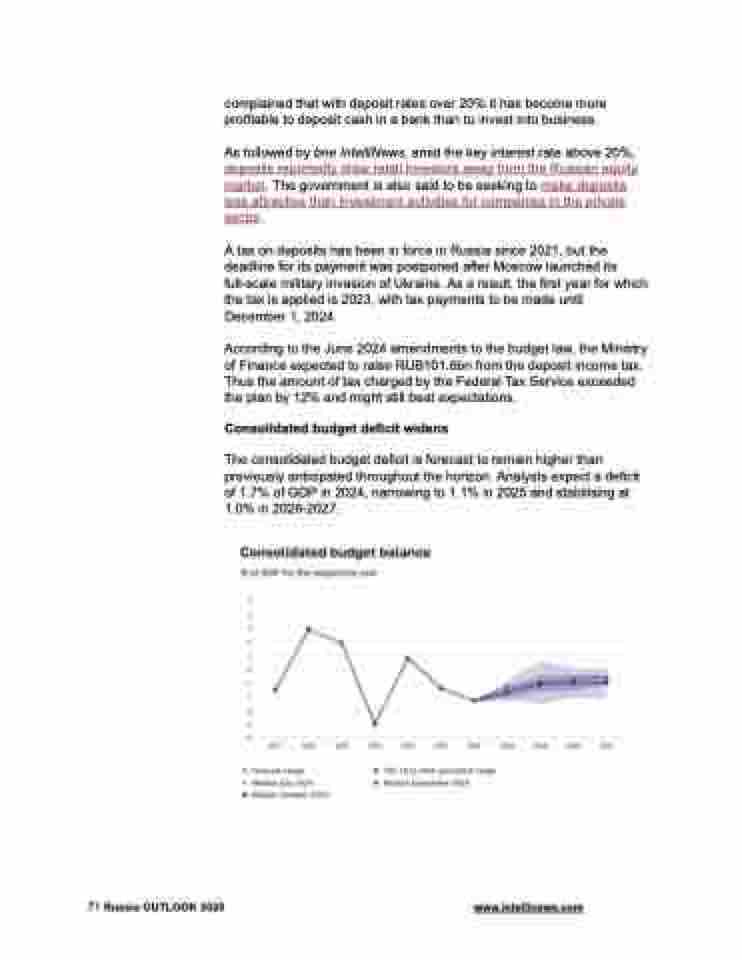

Consolidated budget deficit widens

The consolidated budget deficit is forecast to remain higher than previously anticipated throughout the horizon. Analysts expect a deficit of 1.7% of GDP in 2024, narrowing to 1.1% in 2025 and stabilising at 1.0% in 2026-2027.

71 Russia OUTLOOK 2025 www.intellinews.com