Page 72 - bne IntelliNews Russia OUTLOOK 2025

P. 72

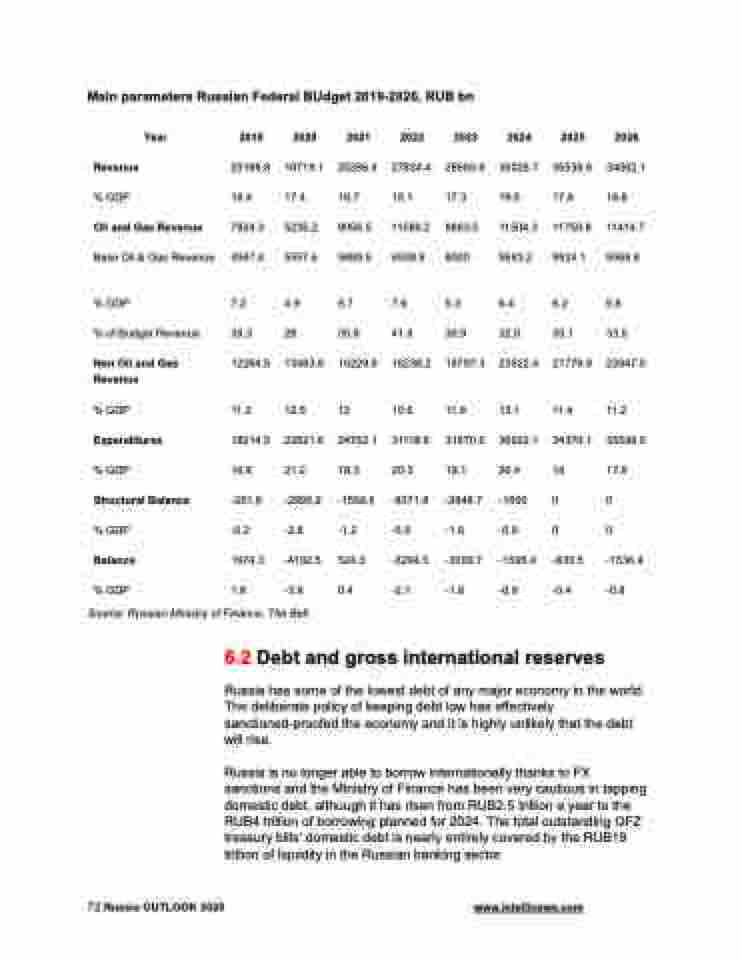

Main parameters Russian Federal BUdget 2019-2026, RUB bn

Year Revenue

% GDP

Oil and Gas Revenue

Base Oil & Gas Revenue

% GDP

% of Budget Revenue

Non Oil and Gas Revenue

% GDP

Expenditures

% GDP

Structural Balance

% GDP

Balance

% GDP

2019 2020 2021

20188.8 18719.1 25286.4 18.4 17.4 18.7 7924.3 5235.2 9056.5 4967.4 5557.6 5889.5

7.2 4.9 6.7

39.3 28 35.8 12264.5 13483.8 16229.9

11.2 12.5 12

18214.5 22821.6 24762.1

16.6 21.2 18.3

-251.8 -2995.9 -1558.5

-0.2 -2.8 -1.2

1974.3 -4102.5 524.3

1.8 -3.8 0.4

2022 2023

27824.4 28660.9 18.1 17.3 11586.2 8863.5 6508.9 8000

7.6 5.3

41.6 30.9 16238.2 19797.3

10.6 11.9 31118.9 31670.6 20.3 19.1 -8371.8 -2648.7 -5.5 -1.6 -3294.5 -3009.7 -2.1 -1.8

2024 2025

35026.7 35539.6 19.5 17.6 11504.3 11759.8 9683.2 9924.1

6.4 6.2

32.8 35.1 23522.4 21779.9

13.1 11.4 36622.1 34370.1 20.4 18 -1600 0

-0.9 0 -1595.4 -830.5 -0.9 -0.4

2026

34062.1 16.8 11414.7 9569.8

5.6

33.5 22647.5

11.2 35598.6 17.6

0

0 -1536.4 -0.8

Source: Russian Ministry of Finance, The Bell.

6.2 Debt and gross international reserves

Russia has some of the lowest debt of any major economy in the world. The deliberate policy of keeping debt low has effectively sanctioned-proofed the economy and it is highly unlikely that the debt will rise.

Russia is no longer able to borrow internationally thanks to FX sanctions and the Ministry of Finance has been very cautious in tapping domestic debt, although it has risen from RUB2.5 trillion a year to the RUB4 trillion of borrowing planned for 2024. The total outstanding OFZ treasury bills’ domestic debt is nearly entirely covered by the RUB19 trillion of liquidity in the Russian banking sector.

72 Russia OUTLOOK 2025

www.intellinews.com