Page 86 - bne IntelliNews Russia OUTLOOK 2025

P. 86

7.5 Commodity prices

ING projects bearish trends amid supply comfort and trade risks

ING's commodities outlook in December anticipates a bearish trajectory for 2025, with many sectors expected to decline due to balanced supply and demand dynamics. The report highlights potential escalations in trade tensions and the uncertain impact of Chinese economic support measures as significant factors influencing market movements.

Energy Markets

The oil sector is projected to experience modest demand growth, influenced by both cyclical and structural factors. Concurrently, non-OPEC supply is expected to rise, while OPEC maintains substantial spare production capacity, suggesting a potential market surplus. Natural gas prices in Europe may trend lower, contingent on winter developments. A typical winter could lead to comfortable storage levels, with new LNG export capacities enabling the EU to replenish supplies without relying on Russian pipeline gas via Ukraine. In contrast, the expansion of US LNG export capacity indicates a tightening domestic market, potentially elevating US natural gas prices.

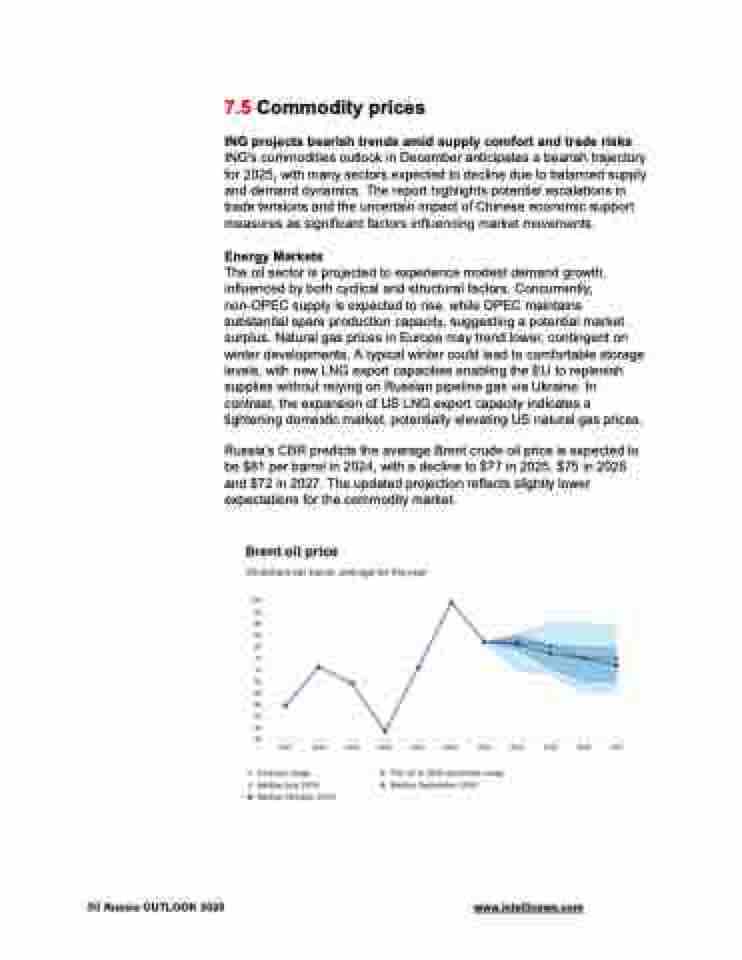

Russia’s CBR predicts the average Brent crude oil price is expected to be $81 per barrel in 2024, with a decline to $77 in 2025, $75 in 2026 and $72 in 2027. The updated projection reflects slightly lower expectations for the commodity market.

86 Russia OUTLOOK 2025 www.intellinews.com