Page 7 - LatAmOil Week 39 2021

P. 7

LatAmOil COLOMBIA/NICARAGUA LatAmOil

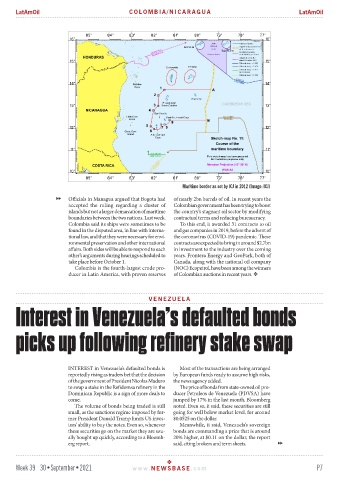

Maritime border as set by ICJ in 2012 (Image: ICJ)

Officials in Managua argued that Bogota had of nearly 2bn barrels of oil. In recent years the

accepted the ruling regarding a cluster of Colombian government has been trying to boost

islands but not a larger demarcation of maritime the country’s stagnant oil sector by modifying

boundaries between the two nations. Last week, contractual terms and reducing bureaucracy.

Colombia said its ships were sometimes to be To this end, it awarded 31 contracts to oil

found in the disputed area, in line with interna- and gas companies in 2019, before the advent of

tional law, and that they were necessary for envi- the coronavirus (COVID-19) pandemic. These

ronmental preservation and other international contracts are expected to bring in around $2.7bn

affairs. Both sides will be able to respond to each in investment to the industry over the coming

other’s arguments during hearings scheduled to years. Frontera Energy and GeoPark, both of

take place before October 1. Canada, along with the national oil company

Colombia is the fourth-largest crude pro- (NOC) Ecopetrol, have been among the winners

ducer in Latin America, with proven reserves of Colombian auctions in recent years.

VENEZUEL A

Interest in Venezuela’s defaulted bonds

picks up following refinery stake swap

INTEREST in Venezuela’s defaulted bonds is Most of the transactions are being arranged

reportedly rising as traders bet that the decision by European funds ready to assume high risks,

of the government of President Nicolas Maduro the news agency added.

to swap a stake in the Refidomsa refinery in the The price of bonds from state-owned oil pro-

Dominican Republic is a sign of more deals to ducer Petroleos de Venezuela (PDVSA) have

come. jumped by 17% in the last month, Bloomberg

The volume of bonds being traded is still noted. Even so, it said, these securities are still

small, as the sanctions regime imposed by for- going for well below market level, for around

mer President Donald Trump limits US inves- $0.0525 on the dollar.

tors’ ability to buy the notes. Even so, whenever Meanwhile, it said, Venezuela’s sovereign

these securities go on the market they are usu- bonds are commanding a price that is around

ally bought up quickly, according to a Bloomb- 20% higher, at $0.11 on the dollar, the report

erg report. said, citing brokers and term sheets.

Week 39 30•September•2021 www. NEWSBASE .com P7