Page 20 - bne IntelliNews Turkey Outlook 2024

P. 20

Turkish banks conduct 367-day (a ‘trick’ maturity for registering loans as long-term that uses two extra days) syndicated loan renewal seasons twice a year, with one season in spring (April-July) and the other in autumn (October-November).

They release identical costs, while some of the lenders, particularly smaller ones, pay higher fees.

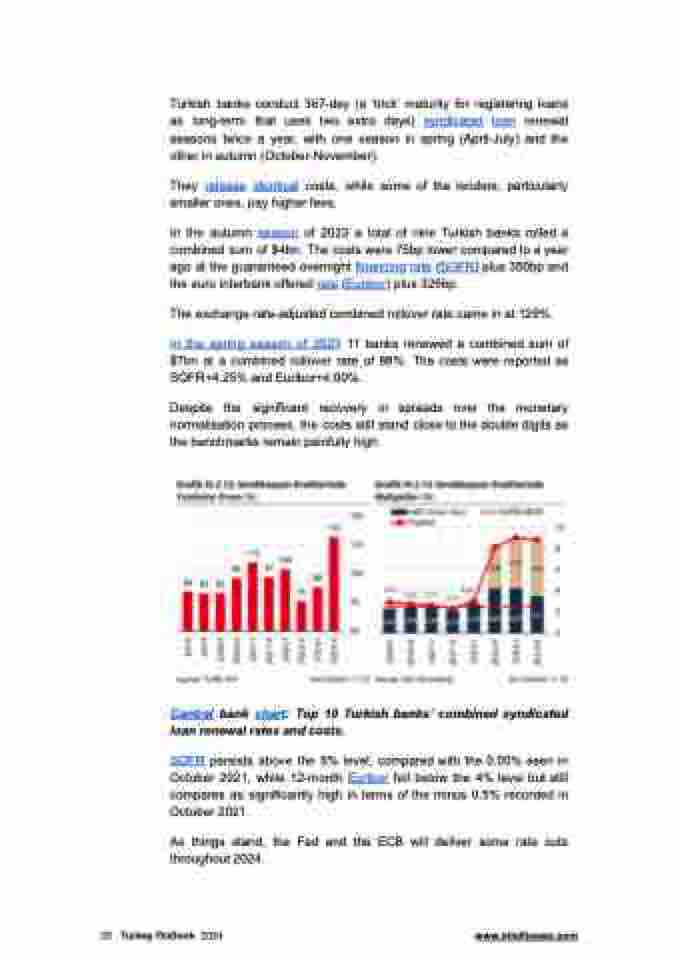

In the autumn season of 2023 a total of nine Turkish banks rolled a combined sum of $4bn. The costs were 75bp lower compared to a year ago at the guaranteed overnight financing rate (SOFR) plus 350bp and the euro interbank offered rate (Euribor) plus 325bp.

The exchange rate-adjusted combined rollover rate came in at 129%.

In the spring season of 2023 11 banks renewed a combined sum of $7bn at a combined rollover rate of 88%. The costs were reported as SOFR+4.25% and Euribor+4.00%.

Despite the significant recovery in spreads over the monetary normalisation process, the costs still stand close to the double digits as the benchmarks remain painfully high.

Central bank chart: Top 10 Turkish banks’ combined syndicated loan renewal rates and costs.

SOFR persists above the 5% level, compared with the 0.05% seen in October 2021, while 12-month Euribor fell below the 4% level but still compares as significantly high in terms of the minus 0.5% recorded in October 2021.

As things stand, the Fed and the ECB will deliver some rate cuts throughout 2024.

20 Turkey Outlook 2024 www.intellinews.com