Page 11 - Kazakh Outlook 2024

P. 11

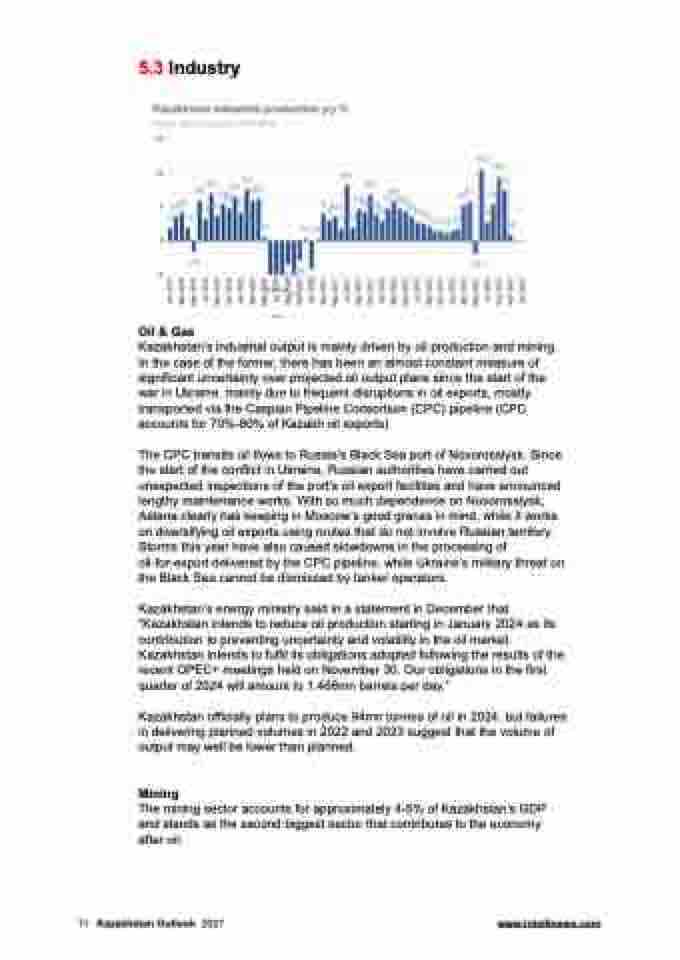

5.3 Industry

Oil & Gas

Kazakhstan’s industrial output is mainly driven by oil production and mining. In the case of the former, there has been an almost constant measure of significant uncertainty over projected oil output plans since the start of the war in Ukraine, mainly due to frequent disruptions in oil exports, mostly transported via the Caspian Pipeline Consortium (CPC) pipeline (CPC accounts for 70%-80% of Kazakh oil exports).

The CPC transits oil flows to Russia’s Black Sea port of Novorossiysk. Since the start of the conflict in Ukraine, Russian authorities have carried out unexpected inspections of the port’s oil export facilities and have announced lengthy maintenance works. With so much dependence on Novorossiysk, Astana clearly has keeping in Moscow’s good graces in mind, while it works on diversifying oil exports using routes that do not involve Russian territory. Storms this year have also caused slowdowns in the processing of oil-for-export delivered by the CPC pipeline, while Ukraine’s military threat on the Black Sea cannot be dismissed by tanker operators.

Kazakhstan’s energy ministry said in a statement in December that “Kazakhstan intends to reduce oil production starting in January 2024 as its contribution to preventing uncertainty and volatility in the oil market. Kazakhstan intends to fulfil its obligations adopted following the results of the recent OPEC+ meetings held on November 30. Our obligations in the first quarter of 2024 will amount to 1.468mn barrels per day.”

Kazakhstan officially plans to produce 94mn tonnes of oil in 2024, but failures in delivering planned volumes in 2022 and 2023 suggest that the volume of output may well be lower than planned.

Mining

The mining sector accounts for approximately 4-5% of Kazakhstan’s GDP and stands as the second biggest sector that contributes to the economy after oil.

11 Kazakhstan Outlook 2021 www.intellinews.com