Page 128 - NobleCon19revC2_Neat

P. 128

Materials

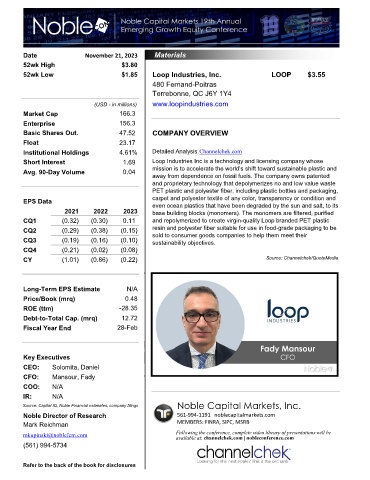

Date November 21, 2023 Materials

52wk High $3.80

52wk Low $1.85 Loop Industries, Inc. LOOP $3.55

480 Fernand-Poitras

Terrebonne, QC J6Y 1Y4

(USD - in millions) www.loopindustries.com

Market Cap 166.3

Enterprise 156.3

Basic Shares Out. 47.52 COMPANY OVERVIEW

Float 23.17

Institutional Holdings 4.61% Detailed Analysis:Channelchek.com

Short Interest 1.69 Loop Industries Inc is a technology and licensing company whose

Avg. 90-Day Volume 0.04 mission is to accelerate the world’s shift toward sustainable plastic and

away from dependence on fossil fuels. The company owns patented

and proprietary technology that depolymerizes no and low value waste

PET plastic and polyester fiber, including plastic bottles and packaging,

EPS Data carpet and polyester textile of any color, transparency or condition and

even ocean plastics that have been degraded by the sun and salt, to its

2021 2022 2023 base building blocks (monomers). The monomers are filtered, purified

CQ1 (0.32) (0.30) 0.11 and repolymerized to create virgin-quality Loop branded PET plastic

CQ2 (0.29) (0.38) (0.15) resin and polyester fiber suitable for use in food-grade packaging to be

sold to consumer goods companies to help them meet their

CQ3 (0.19) (0.16) (0.10) sustainability objectives.

CQ4 (0.21) (0.02) (0.08)

CY (1.01) (0.86) (0.22) Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 0.48

ROE (ttm) -28.35

Debt-to-Total Cap. (mrq) 12.72

Fiscal Year End 28-Feb

480 Fernand-PTerrebonne QC J6Y 1Y4

Key Executives

CEO: Solomita, Daniel

CFO: Mansour, Fady

COO: N/A

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Director of Research 561-994-1191 noblecapitalmarkets.com

Mark Reichman MEMBERS: FINRA, SIPC, MSRB

mkupinski@noblefcm.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 994-5734

Refer to the back of the book for disclosures