Page 130 - NobleCon19revC2_Neat

P. 130

Real Estate

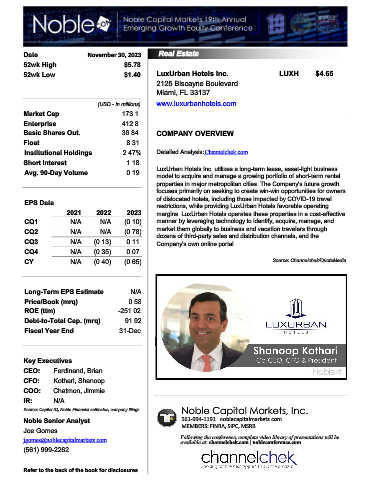

Date November 30, 2023 Real Estate

52wk High $5.78

52wk Low $1.40 LuxUrban Hotels Inc. LUXH $4.65

2125 Biscayne Boulevard

Miami, FL 33137

(USD - in millions) www.luxurbanhotels.com

Market Cap 173.1

Enterprise 412.8

Basic Shares Out. 36.84 COMPANY OVERVIEW

Float 8.31

Institutional Holdings 2.47% Detailed Analysis:Channelchek.com

Short Interest 1.18

Avg. 90-Day Volume 0.19 LuxUrban Hotels Inc. utilizes a long-term lease, asset-light business

model to acquire and manage a growing portfolio of short-term rental

properties in major metropolitan cities. The Company's future growth

focuses primarily on seeking to create win-win opportunities for owners

EPS Data of dislocated hotels, including those impacted by COVID-19 travel

restrictions, while providing LuxUrban Hotels favorable operating

2021 2022 2023 margins. LuxUrban Hotels operates these properties in a cost-effective

CQ1 N/A N/A (0.10) manner by leveraging technology to identify, acquire, manage, and

CQ2 N/A N/A (0.78) market them globally to business and vacation travelers through

dozens of third-party sales and distribution channels, and the

CQ3 N/A (0.13) 0.11 Company's own online portal.

CQ4 N/A (0.35) 0.07

CY N/A (0.40) (0.65) Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 0.58

ROE (ttm) -251.02

Debt-to-Total Cap. (mrq) 91.92

Fiscal Year End 31-Dec

2125 Biscayne Miami FL 33137

Key Executives

CEO: Ferdinand, Brian

CFO: Kothari, Shanoop

COO: Chatmon, Jimmie

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Joe Gomes MEMBERS: FINRA, SIPC, MSRB

jgomes@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 999-2262

Refer to the back of the book for disclosures