Page 98 - NobleCon20-Book-Project

P. 98

Information

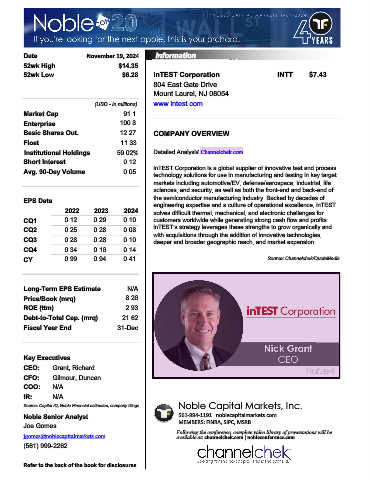

Date November 19, 2024 Information Technology

52wk High $14.35

52wk Low $6.28 inTEST Corporation INTT $7.43

804 East Gate Drive

Mount Laurel, NJ 08054

(USD - in millions) www.intest.com

Market Cap 91.1

Enterprise 100.8

Basic Shares Out. 12.27 COMPANY OVERVIEW

Float 11.33

Institutional Holdings 59.02% Detailed Analysis:Channelchek.com

Short Interest 0.12

Avg. 90-Day Volume 0.05 inTEST Corporation is a global supplier of innovative test and process

technology solutions for use in manufacturing and testing in key target

markets including automotive/EV, defense/aerospace, industrial, life

sciences, and security, as well as both the front-end and back-end of

EPS Data the semiconductor manufacturing industry. Backed by decades of

engineering expertise and a culture of operational excellence, inTEST

2022 2023 2024 solves difficult thermal, mechanical, and electronic challenges for

CQ1 0.12 0.29 0.10 customers worldwide while generating strong cash flow and profits.

CQ2 0.25 0.28 0.08 inTEST’s strategy leverages these strengths to grow organically and

with acquisitions through the addition of innovative technologies,

CQ3 0.28 0.28 0.10 deeper and broader geographic reach, and market expansion.

CQ4 0.34 0.16 0.14

CY 0.99 0.94 0.41 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 8.26

ROE (ttm) 2.93

Debt-to-Total Cap. (mrq) 21.62

Fiscal Year End 31-Dec

804 East Gate Mount Laurel NJ 08054

Key Executives

CEO: Grant, Richard

CFO: Gilmour, Duncan

COO: N/A

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Joe Gomes MEMBERS: FINRA, SIPC, MSRB

Following the conference, complete video library of presentations will be

jgomes@noblecapitalmarkets.com available at: channelchek.com | nobleconference.com

(561) 999-2262

Refer to the back of the book for disclosures