Page 17 - First Churches 2019-20Annual Report.docx

P. 17

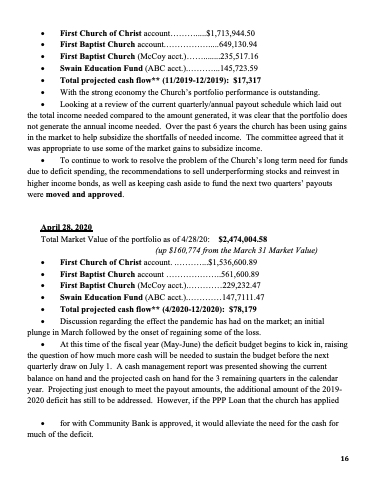

• First Church of Christ account..............$1,713,944.50

• First Baptist Church account.....................649,130.94

• First Baptist Church (McCoy acct.)..............235,517.16

• Swain Education Fund (ABC acct.).............145,723.59

• Total projected cash flow** (11/2019-12/2019): $17,317

• With the strong economy the Church’s portfolio performance is outstanding.

• Looking at a review of the current quarterly/annual payout schedule which laid out

the total income needed compared to the amount generated, it was clear that the portfolio does not generate the annual income needed. Over the past 6 years the church has been using gains in the market to help subsidize the shortfalls of needed income. The committee agreed that it was appropriate to use some of the market gains to subsidize income.

• To continue to work to resolve the problem of the Church’s long term need for funds due to deficit spending, the recommendations to sell underperforming stocks and reinvest in higher income bonds, as well as keeping cash aside to fund the next two quarters’ payouts were moved and approved.

April 28, 2020

Total Market Value of the portfolio as of 4/28/20: $2,474,004.58

(up $160,774 from the March 31 Market Value)

• First Church of Christ account. .............$1,536,600.89

• First Baptist Church account ....................561,600.89

• First Baptist Church (McCoy acct.).............229,232.47

• Swain Education Fund (ABC acct.).............147,7111.47

• Total projected cash flow** (4/2020-12/2020): $78,179

• Discussion regarding the effect the pandemic has had on the market; an initial plunge in March followed by the onset of regaining some of the loss.

• At this time of the fiscal year (May-June) the deficit budget begins to kick in, raising the question of how much more cash will be needed to sustain the budget before the next quarterly draw on July 1. A cash management report was presented showing the current balance on hand and the projected cash on hand for the 3 remaining quarters in the calendar year. Projecting just enough to meet the payout amounts, the additional amount of the 2019- 2020 deficit has still to be addressed. However, if the PPP Loan that the church has applied

• for with Community Bank is approved, it would alleviate the need for the cash for much of the deficit.

16