Page 18 - First Churches 2019-20Annual Report.docx

P. 18

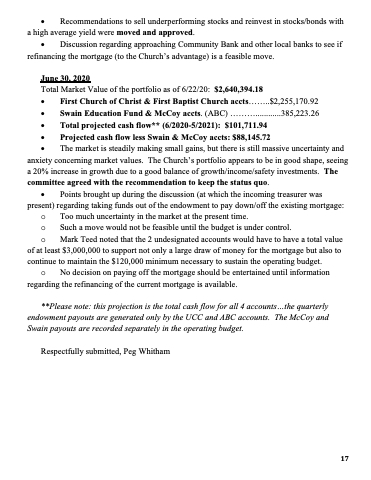

• Recommendations to sell underperforming stocks and reinvest in stocks/bonds with a high average yield were moved and approved.

• Discussion regarding approaching Community Bank and other local banks to see if refinancing the mortgage (to the Church’s advantage) is a feasible move.

June 30, 2020

Total Market Value of the portfolio as of 6/22/20: $2,640,394.18

• First Church of Christ & First Baptist Church accts........$2,255,170.92

• Swain Education Fund & McCoy accts. (ABC) .....................385,223.26

• Total projected cash flow** (6/2020-5/2021): $101,711.94

• Projected cash flow less Swain & McCoy accts: $88,145.72

• The market is steadily making small gains, but there is still massive uncertainty and

anxiety concerning market values. The Church’s portfolio appears to be in good shape, seeing a 20% increase in growth due to a good balance of growth/income/safety investments. The committee agreed with the recommendation to keep the status quo.

• Points brought up during the discussion (at which the incoming treasurer was present) regarding taking funds out of the endowment to pay down/off the existing mortgage:

o Too much uncertainty in the market at the present time.

o Such a move would not be feasible until the budget is under control.

o Mark Teed noted that the 2 undesignated accounts would have to have a total value

of at least $3,000,000 to support not only a large draw of money for the mortgage but also to continue to maintain the $120,000 minimum necessary to sustain the operating budget.

o No decision on paying off the mortgage should be entertained until information regarding the refinancing of the current mortgage is available.

**Please note: this projection is the total cash flow for all 4 accounts...the quarterly endowment payouts are generated only by the UCC and ABC accounts. The McCoy and Swain payouts are recorded separately in the operating budget.

Respectfully submitted, Peg Whitham

17