Page 3 - Bramasol_eBook-Overview of IFRS 9

P. 3

Background

AIFRS 9 Financial Instruments is the IASB’s replacement of IAS 39 Financial Instruments: Recognition and Measurement.

The Standard includes requirements for recognition and measurement, impairment, derecognition and general hedge

accounting.

IFRS 9 issued in 2014 supersedes all previous versions and is mandatorily effective for periods beginning on or after 1

January 2018 with early adoption permitted (subject to local endorsement requirements). For a limited period, previous

versions of IFRS 91 may be adopted early, provided the relevant date of initial application is before 1 February 2015

(again, subject to local endorsement requirements).

The new standard is based on the concept that financial assets should be classified and measured at fair value, with

changes in fair value recognized in profit and loss as they arise (“FVPL”), unless restrictive criteria are met for classifying

and measuring the asset at either Amortized Cost or Fair Value Through Other Comprehensive Income (“FVOCI”).

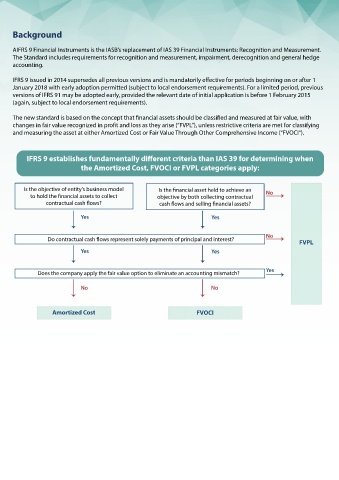

IFRS 9 establishes fundamentally di erent criteria than IAS 39 for determining when

the Amortized Cost, FVOCI or FVPL categories apply:

Is the objective of entity's business model Is the nancial asset held to achieve an No

to hold the nancial assets to collect objective by both collecting contractual

contractual cash ows? cash ows and selling nancial assets?

Yes Yes

No

Do contractual cash ows represent solely payments of principal and interest? FVPL

Yes Yes

Yes

Does the company apply the fair value option to eliminate an accounting mismatch?

No No

Amortized Cost FVOCI

3 Copyright © 2018 Bramasol Inc. www.bramasol.com