Page 4 - 000 Complete EBook - 403(b) & 457(b) Test 12202017 1

P. 4

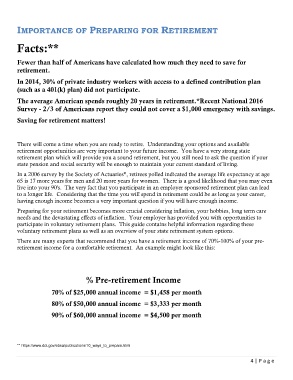

IMPORTANCE OF PREPARING FOR RETIREMENT

Facts:**

Fewer than half of Americans have calculated how much they need to save for

retirement.

In 2014, 30% of private industry workers with access to a defined contribution plan

(such as a 401(k) plan) did not participate.

The average American spends roughly 20 years in retirement.*Recent National 2016

Survey - 2/3 of Americans report they could not cover a $1,000 emergency with savings.

Saving for retirement matters!

There will come a time when you are ready to retire. Understanding your options and available

retirement opportunities are very important to your future income. You have a very strong state

retirement plan which will provide you a sound retirement, but you still need to ask the question if your

state pension and social security will be enough to maintain your current standard of living.

In a 2006 survey by the Society of Actuaries*, retirees polled indicated the average life expectancy at age

65 is 17 more years for men and 20 more years for women. There is a good likelihood that you may even

live into your 90's. The very fact that you participate in an employer sponsored retirement plan can lead

to a longer life. Considering that the time you will spend in retirement could be as long as your career,

having enough income becomes a very important question if you will have enough income.

Preparing for your retirement becomes more crucial considering inflation, your hobbies, long term care

needs and the devastating effects of inflation. Your employer has provided you with opportunities to

participate in voluntary retirement plans. This guide contains helpful information regarding these

voluntary retirement plans as well as an overview of your state retirement system options.

There are many experts that recommend that you have a retirement income of 70%-100% of your pre-

retirement income for a comfortable retirement. An example might look like this:

% Pre-retirement Income

70% of $25,000 annual income = $1,458 per month

80% of $50,000 annual income = $3,333 per month

90% of $60,000 annual income = $4,500 per month

** https://www.dol.gov/ebsa/publications/10_ways_to_prepare.html

4 | P a g e