Page 16 - 2017-2018 NSE FACTBOOK.cdr

P. 16

2017/2018 NSE FACT BOOK 2017/2018 NSE FACT BOOK

The Performance Documentary of Listed Nigerian Companies The Performance Documentary of Listed Nigerian Companies

2017 Annual Review and 2018 Outlook

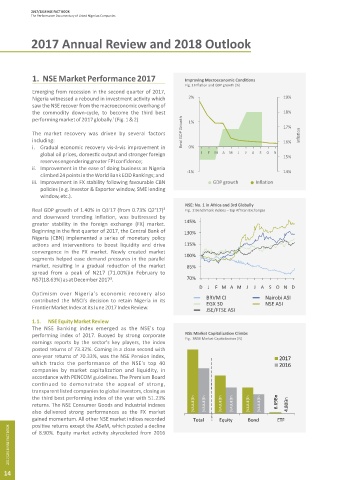

1. NSE Market Performance 2017 Improving Macroeconomic Condi ons levels, as market turnover increased by 121% to N1.27Tn. 1.3. NSE ETF Market Review

Fig. 1 Infla on and GDP growth (%) For the second consecu ve year, domes c investment

Emerging from recession in the second quarter of 2017, flows outweighed FPI flows, albeit marginally. Overall, the The NSE's ETF market witnessed increased ac vity across

Nigeria witnessed a rebound in investment ac vity which 2% 19% domes c retail segment recorded the least growth during key metrics in 2017, recording a 272% year-on-year growth

saw the NSE recover from the macroeconomic overhang of the year. As at November 2017, the value of domes c retail in trade volumes, 33% growth in turnover and a 39.5%

the commodity down-cycle, to become the third best 18% trade totaled N364Bn which represents a modest year-on-year increase in market capitaliza on to close the

performing market of 2017 globally.¹ (Fig. 1 & 2) 1% increment of 39% from the previous year, compared with year at N6.69Bn. This is a ributable to growing adop on of

the asset class by investors and asset managers, as well as

the triple-digit growth recorded in all other investor

The market recovery was driven by several factors Real GDP Growth 17% Infla on classes. Reviewing FPI trends for the year, we note that the new issuance of 2017- the Stanbic IBTC Asset

including: 16% foreign inflows outpaced ou lows in 2017, with posi ve Management Limited (SIAML) Pension ETF 40 - which is the

i. Gradual economic recovery vis-à-vis improvement in 0% net flows sustaining from March 2017, and peaking in NSE's first pension based ETF.

global oil prices, domes c output and stronger foreign J F M A M J J A S O N 15% August 2017 on the back of posi ve economic data

reserves engendering greater FPI confidence; releases such as the second quarter GDP report and rising With regard to market performance, the Ve va Banking

ii. Improvement in the ease of doing business as Nigeria PMI readings. ETF posted the highest return of 70.00% in the ETF market

-1% 14%

climbed 24 points in the World Bank EOD Rankings; and segment, closely mirroring the gains recorded by the

iii. Improvement in FX stability following favourable CBN GDP growth Infla on IPO ac vity in the year remained mute, however there banking sector and its benchmark - The NSE Banking Index,

policies (e.g. Investor & Exporter window, SME lending were several other posi ve indicators including the revival whilst the NewGold ETF – which tracks the spot price of

window, etc.). of supplementary lis ngs and the return of new issuances. gold – posted the second highest returns (47.87%). The

The market saw a nine (9) fold increase in the value of new Sector Based ETFs – tracking the NSE Banking, Consumer

NSE: No. 1 in Africa and 3rd Globally

Real GDP growth of 1.40% in Q3'17 (from 0.73% Q2'17)² Fig. 2 Benchmark indices – top African Exchanges issuances, buoyed by M&A transac ons, lis ngs by Goods and Industrial sectors – were the most ac vely

and downward trending infla on, was bu ressed by introduc on, rights issues and others, bringing the total traded ETFs.ETF

greater stability in the foreign exchange (FX) market. 145% value of equity issues in 2017 to N408Bn.

Beginning in the first quarter of 2017, the Central Bank of 130%

Nigeria (CBN) implemented a series of monetary policy

ac ons and interven ons to boost liquidity and drive 115% 1.2. NSE Bond Market Review

convergence in the FX market. Newly created market

segments helped ease demand pressures in the parallel 100% The NSE fixed income market recorded mixed

market, resul ng in a gradual reduc on of the market 85% performance. New bond issuances increased over the 272%

spread from a peak of N217 (71.00%)in February to previous year; bond yields gradually moderated from 2016

Equity

N57(18.63%) as at December 2017³. 70% levels amidst easing infla on and greater FX stability. Yields year-on-year market turnover

across various tenors declined between 0.4% – 1.5%and

D J F M A M J J A S O N D growth in ETF trade increased by

Op mism over Nigeria's economic recovery also market turnover declined by 26% in 2017, as investors

BRVM CI Nairobi ASI sought higher returns in alterna ve product classes. volumes 121% to

contributed the MSCI's decision to retain Nigeria in its EGX 30 NSE ASI

Fron er Market Index at its June 2017 Index Review. N1.27Tn

JSE/FTSE ASI

Bond raising ac vity was dominated by the Federal

1.1. NSE Equity Market Review Government of Nigeria (FGN), as it con nued to leverage

The NSE Banking index emerged as the NSE's top the capital market to finance the MTEF and rising fiscal

performing index of 2017. Buoyed by strong corporate NSE Market Capitaliza on Climbs deficits. The year 2017 saw the lis ng of the $1.5Bn FGN

Fig. 3NSE Market Capitaliza on (N) The NSE Banking

earnings reports by the sector's key players, the index Eurobond which was approximately eight (8) mes

posted returns of 73.32%. Coming in a close second with oversubscribed in interna onal capital markets⁴. Other Index emerged NSE’s top

one-year returns of 70.33%, was the NSE Pension index, 2017 pioneer issuances during the year included the: (i) maiden performing index of 2017,

which tracks the performance of the NSE's top 40 2016 5-year, $300Mn FGN Diaspora Bond, (ii) N100Bn FGN pos ng

companies by market capitaliza on and liquidity, in Sukuk bond; and (iii)the record-se ng N10.69bn FGN

accordance with PENCOM guidelines. The Premium Board Green Bond, which is the first Green Bond issued by an 73.32%

con nued to demonstrate the appeal of strong, African Sovereign and the first Climate Bonds Cer fied

transparent listed companies to global investors, closing as Sovereign Bond ever issued. Conversely, the domes c returns

the third best performing index of the year with 51.23% corporate bond market saw a slowdown in ac vity rela ve

returns. The NSE Consumer Goods and Industrial indexes [VALUE]Tn [VALUE]Tn [VALUE]Tn [VALUE]Tn [VALUE]Tn [VALUE]Tn 6.69Bn 4.80Bn to 2016; corporates raised N21.5Bn in three (3) lis ngs in

also delivered strong performances as the FX market 2017, represen ng a 75% decline from N86.1Bn recorded

gained momentum. All other NSE market indices recorded Total Equity Bond ETF in 2016.

posi ve returns except the ASeM, which posted a decline

2017/2018 NSE FACTBOOK of 8.90%. Equity market ac vity skyrocketed from 2016 2017/2018 NSE FACTBOOK

14 15