Page 256 - IOM Law Society Rules Book

P. 256

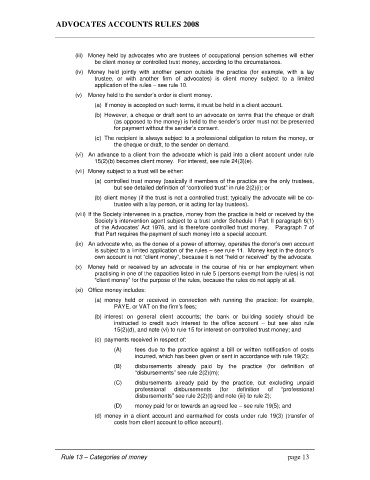

ADVOCATES ACCOUNTS RULES 2008

(iii) Money held by advocates who are trustees of occupational pension schemes will either

be client money or controlled trust money, according to the circumstances.

(iv) Money held jointly with another person outside the practice (for example, with a lay

trustee, or with another firm of advocates) is client money subject to a limited

application of the rules – see rule 10.

(v) Money held to the sender’s order is client money.

(a) If money is accepted on such terms, it must be held in a client account.

(b) However, a cheque or draft sent to an advocate on terms that the cheque or draft

(as opposed to the money) is held to the sender’s order must not be presented

for payment without the sender’s consent.

(c) The recipient is always subject to a professional obligation to return the money, or

the cheque or draft, to the sender on demand.

(vi) An advance to a client from the advocate which is paid into a client account under rule

15(2)(b) becomes client money. For interest, see rule 24(3)(e).

(vii) Money subject to a trust will be either:

(a) controlled trust money (basically if members of the practice are the only trustees,

but see detailed definition of “controlled trust” in rule 2(2)(i); or

(b) client money (if the trust is not a controlled trust; typically the advocate will be co-

trustee with a lay person, or is acting for lay trustees).

(viii) If the Society intervenes in a practice, money from the practice is held or received by the

Society’s intervention agent subject to a trust under Schedule I Part II paragraph 6(1)

of the Advocates’ Act 1976, and is therefore controlled trust money. Paragraph 7 of

that Part requires the payment of such money into a special account.

(ix) An advocate who, as the donee of a power of attorney, operates the donor’s own account

is subject to a limited application of the rules – see rule 11. Money kept in the donor’s

own account is not “client money”, because it is not “held or received” by the advocate.

(x) Money held or received by an advocate in the course of his or her employment when

practising in one of the capacities listed in rule 5 (persons exempt from the rules) is not

“client money” for the purpose of the rules, because the rules do not apply at all.

(xi) Office money includes:

(a) money held or received in connection with running the practice: for example,

PAYE, or VAT on the firm’s fees;

(b) interest on general client accounts; the bank or building society should be

instructed to credit such interest to the office account – but see also rule

15(2)(d), and note (vi) to rule 15 for interest on controlled trust money; and

(c) payments received in respect of:

(A) fees due to the practice against a bill or written notification of costs

incurred, which has been given or sent in accordance with rule 19(2);

(B) disbursements already paid by the practice (for definition of

“disbursements” see rule 2(2)(m);

(C) disbursements already paid by the practice, but excluding unpaid

professional disbursements (for definition of “professional

disbursements” see rule 2(2)(t) and note (iii) to rule 2);

(D) money paid for or towards an agreed fee – see rule 19(5); and

(d) money in a client account and earmarked for costs under rule 19(3) (transfer of

costs from client account to office account).

Rule 13 – Categories of money page 13