Page 59 - CPM Sri Lanka Annual Report 2020-2021

P. 59

ACCELERATION THROUGH 59

ADAPTATION

CPM Sri Lanka | Annual Report 2020-2021

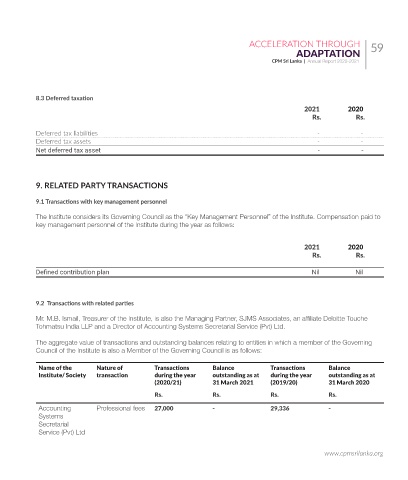

8.3 Deferred taxation

2021 2020

Rs. Rs.

Deferred tax liabilities - -

Deferred tax assets - -

Net deferred tax asset - -

9. RELATED PARTY TRANSACTIONS

9.1 Transactions with key management personnel

The Institute considers its Governing Council as the “Key Management Personnel” of the Institute. Compensation paid to

key management personnel of the Institute during the year as follows:

2021 2020

Rs. Rs.

Defined contribution plan Nil Nil

9.2 Transactions with related parties

Mr. M.B. Ismail, Treasurer of the Institute, is also the Managing Partner, SJMS Associates, an affiliate Deloitte Touche

Tohmatsu India LLP and a Director of Accounting Systems Secretarial Service (Pvt) Ltd.

The aggregate value of transactions and outstanding balances relating to entities in which a member of the Governing

Council of the Institute is also a Member of the Governing Council is as follows:

Name of the Nature of Transactions Balance Transactions Balance

Institute/ Society transaction during the year outstanding as at during the year outstanding as at

(2020/21) 31 March 2021 (2019/20) 31 March 2020

Rs. Rs. Rs. Rs.

Accounting Professional fees 27,000 - 29,336 -

Systems

Secretarial

Service (Pvt) Ltd

www.cpmsrilanka.org