Page 370 - Cambridge IGCSE Business Studies

P. 370

Cambridge IGCSE Business Studies Index

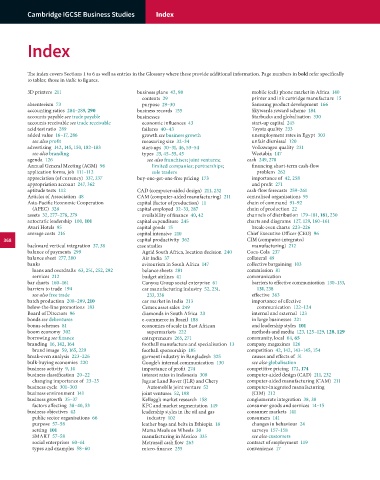

Index

The index covers Sections 1 to 6 as well as entries in the Glossary where these provide additional information. Page numbers in bold refer specifi cally

to tables; those in italic to fi gures.

3D printers 211 business plans 42, 98 mobile (cell) phone market in Africa 140

contents 29 printer and ink cartridge manufacture 15

absenteeism 73 purpose 29–30 Samsung product development 166

accounting ratios 284–289, 290 business records 155 Skywards reward scheme 184

accounts payable see trade payable businesses Starbucks and globalisation 330

accounts receivable see trade receivable economic infl uences 43 start-up capital 245

acid test ratio 289 failures 40–43 Toyota quality 233

added value 16–17, 286 growth see business growth unemployment rates in Egypt 303

see also profi t measuring size 32–34 unfair dismissal 120

advertising 142, 145, 150, 182–183 start-ups 30–31, 46, 53–54 Volkswagen quality 231

see also branding types 25, 45–55, 45 Weetabix 147

agenda 126 see also franchises; joint ventures; cash 249, 278

Annual General Meeting (AGM) 96 limited companies; partnerships; financing short-term cash-fl ow

application forms, job 111–112 sole traders problem 262

appreciation (of currency) 337, 337 buy-one-get-one-free pricing 173 importance of 42, 258

appropriation account 247, 362 and profi t 271

aptitude tests 112 CAD (computer-aided design) 211, 232 cash-fl ow forecasts 259–261

Articles of Association 48 CAM (computer-aided manufacturing) 211 centralised organisations 95

Asia-Pacific Economic Cooperation capital (factor of production) 11 chain of command 91–92

(APEC) 328 capital employed 32–33, 287 chain of production 22

assets 32, 277–278, 279 availability of fi nance 40, 42 channels of distribution 179–181, 181, 230

autocratic leadership 100, 101 capital expenditure 245 charts and diagrams 127, 129, 160–161

Avari Hotels 95 capital goods 15 break-even charts 223–226

average costs 216 capital intensive 210 Chief Executive Offi cer (CEO) 96

368 capital productivity 362 CIM (computer-integrated

backward vertical integration 37, 38 case studies manufacturing) 212

balance of payments 299 Agrid South Africa, location decision 240 Coca-Cola 237

balance sheet 277, 280 Air India 37 collateral 49

banks avitourism in South Africa 147 collective bargaining 103

loans and overdrafts 63, 251, 252, 292 balance sheets 281 commission 81

services 212 budget airlines 41 communication

bar charts 160–161 Canyou Group social enterprise 61 barriers to eff ective communication 130–133,

barriers to trade 194 car manufacturing industry 52, 231, 131, 238

see also free trade 233, 338 eff ective 363

batch production 208–209, 210 car market in India 213 importance of eff ective

below-the-line promotions 183 Cemex asset sales 249 communication 122–124

Board of Directors 96 diamonds in South Africa 23 internal and external 123

bonds see debentures e-commerce in Brazil 188 in large businesses 221

bonus schemes 81 economies of scale in East African and leadership styles 101

boom economy 302 supermarkets 222 methods and media 123, 125–129, 128, 129

borrowing see fi nance entrepreneurs 265, 271 community, local 64, 65

branding 16, 142, 164 football manufacture and specialisation 13 company magazines 126

brand image 59, 165, 229 football sponsorship 185 competition 42, 142, 143–145, 154

break-even analysis 223–226 garment industry in Bangladesh 325 causes and eff ects of 31

bulk-buying economies 220 Google’s internal communication 130 see also globalisation

business activity 9, 14 importance of profi t 274 competitive pricing 172, 174

business classifi cation 20–22 interest rates in Indonesia 308 computer-aided design (CAD) 211, 232

changing importance of 23–25 Jaguar Land Rover (JLR) and Chery computer-aided manufacturing (CAM) 211

business cycle 301–303 Automobile joint venture 52 computer-integrated manufacturing

business environment 141 joint ventures 52, 198 (CIM) 212

business growth 35–37 Kellogg’s market research 158 conglomerate integration 38, 38

factors aff ecting 38–40, 53 KFC and market segmentation 149 consumer goods and services 14–15

business objectives 42 leadership styles in the oil and gas consumer markets 141

public sector organisations 66 industry 102 consumers 141

purpose 57–58 leather bags and belts in Ethiopia 18 changes in behaviour 24

setting 101 Mama Meals on Wheels 30 surveys 157–158

SMART 57–58 manufacturing in Mexico 335 see also customers

social enterprises 60–61 Metrorail cash fl ow 263 contract of employment 119

types and examples 58–60 micro-fi nance 255 convenience 17